You are watching “Innovation, Leadership, and Value Creation: Strategies Explored,” a Beet.TV leadership series presented by Progress Partners. For more videos, please visit this page.

This year, a glut of companies have gone public or otherwise raised new money, thanks to a combination of private equity enthusiasm and the new trend in Special Purpose Acquisition Companies (SPACs), essentially a shell company set up by investors with the sole purpose of raising money through an IPO to eventually acquire another company.

In the last few weeks, Beet.TV’s leadership series “Innovation, Leadership, and Value Creation: Strategies Explored,” presented by Progress Partners, has heard several executives’ views and advice on contemporary ad-tech fundraising.

In this final post in the series, we wrap together many of those viewpoints with our series highlights video. If you only watch one video in the series, make it this one.

1. Taboola relishes public pressure

Adam Singolda, founder and CEO of native advertising and content discovery platform Taboola, said the mechanism of market listing isn’t as important as the rationale.

His company joined the Nasdaq in June after merging with ION Acquisition Corp 1, a SPAC.

Taboola’s Debut As Publicly Traded Company Fulfills Long-Term Goal: Founder Adam Singolda

“It doesn’t matter how you become public,” Singolda said. “The bigger decision, as management and as a board you have to make, is ‘Are you ready and how much you want to be a public company?’

“We’ve been wanting to be a public company for a while. Last year was $1.2 billion in revenue. It’s a $60-plus billion market as an alternative to the walled gardens, but there’s no Shopify for advertising. There’s no company that’s just there rooting for the open web in a win-win way of doing it. So we wanted to be that company. We want to be that company.”

2. Mediaocean sees lively finance options

Mediaocean CEO Bill Wise said running a company is neither a marathon nor a sprint, it’s a relay race. In other words, entrepreneurs need to know when to hand over to someone else. He said that places serial leaders at an advantage.

Vista Partners’ majority stake in Mediaocean was last month sold to two other private equity firms, after Mediaocean acquired Flashtalking.

“There has never been more opportunity for entrepreneurs and figuring out that relay race to get your company from initial idea to product launch, to go-to-market, to start generating revenue, to start scaling the company,” Wise said.

“Right now there’s so much opportunities Private equity firms, venture capitalist. There’s so much wealth being created in big tech. There’s a lot of people now, entrepreneurs turning into investors that want to live vicariously through those investments. So you have a lot of individual investors, you have SPACs, you have IPOs. It’s very dynamic market right now.”

3. Tubi followed an unexpected exit

Streaming TV service Tubi may have sold to Fox for $440 million in 2020 – but founder and CEO Farhad Massoudi said he didn’t set out to exit that way.

Tubi was planning on going public when the idea of a sale was mooted.

VCs Are Looking for Entrepreneurs With Big Ideas: Tubi’s Farhad Massoudi

“We were actively working on getting Tubi ready to go public, and we were raising around and financing,” Massoudi said. “I started talking to Fox and just stars aligned. We had similar visions, they were very supportive, they have been very supportive post-acquisition, and it made a lot of sense for us to use the muscle and the power of a large media company

“In terms of the exit opportunities, there is no right way to do it. Sometimes when the opportunity knocks, you have to either take a serious look at it and if it makes sense, execute on it, which is what we did.”

4. Simpli.fi grew thanks to partner input

Simpli.fi CEO Frost Priloeau said the right early-stage partners can be transformational for a tech company.

Simpli.fi took another private equity investment from Blackstone Group in June, valuing it at $1.5 billion.

Blackstone’s Investment in Simpli.fi Marks Latest Stage of Private Equity Funding

“About three years in, we raised a growth capital round and a company called Frontier Growth down in Charlotte came in,” he said. “(It was) really a fantastic growth investor for us, made us focus on some metrics that we weren’t necessarily focused on really – SaaS-type metrics like net recurring revenue, as well as our NPS score and really set us up for the next stage.

“Then in 2017, the growth investors had seen a good return and they wanted to monetize that return. So we went out and looked at sort of who would be the right owner of the company going forward.

“We talked to strategics, but we really hit a great place where we were introduced to a private equity firm named GTCR out of Chicago. They acquired the company along with management in 2017, and they have been really a fantastic partner for us, really helping us build the foundation to grow the company to the next stage.”

5. Innovid keeps focus through finance

Connected TV enabler Innovid’s CEO Zvika Netter said his company has benefitted from finance partners including Genesis, Sequoia, New Spring and Goldman Sachs. But making it through is about a consistent vision, he said.

Innovid recently said it plans to go public to raise $403 million in a deal valuing the business at $1.3 billion.

‘Here To Stay’: Innovid CEO Netter Does IPO To Put CTV Vision In Public Gaze

“You need to have vision, you have passion and it’s about delivering,” Netter said. “So the vision is – it was always the same – we’re here to change the future of TV advertising.

“Obviously, when you raise money in 2008, ’10, ’12, ’17, and the latest one was 2019, the vision stayed the same, reality keeps changing. So you have to keep adjusting to where reality is right now.”

6. Progress Partners sees PE beat SPAC

Progress Partners founder Nick MacShane said it is important companies think of SPAC as just one path, not the only path, to exit.

Progress Partners, an M&A advisory, has been advising a wave of ad-tech companies lately and recently closed a venture round of its own.

Ad-Tech M&A Is Back, Thanks To SPAC: Progress Partners’ MacShane

“The financial buyers are actually looking much more competitive than some of the larger strategics right now,” MacShane said.

“Coming out of COVID, some of the large companies are still struggling with their own businesses and restarting their engines, whereas the private equity is poised and ready to jump in, so you’ve seen some of the larger deals that people thought were going to SPAC have now turned over into private equity.”

7. PubMatic warns against over-financing

PubMatic CEO Rajeev Goel said it is important for companies not to raise more money than is needed.

PubMatic had raised around $16 million before its IPO in December, when it jumped 50% in value.

VC Relationships Are Formed With People, Not Firms: PubMatic’s Rajeev Goel

“You see these huge raises of $200, $300, $400 million,” Goel said. “Sometimes they’re warranted, but in many cases it’s before the company has figured out its core unit economics and things like that.

“That’s a real danger because, if you don’t grow into that valuation that’s implied by that level of fundraise … that can be a real handicap where now a company may not be able to raise any more money. That’s the kind of thing that can put you out of business.”

8. DoubleVerify’s IPO is not the end

Although an IPO is an “exit”, DoubleVerify CEO Mark Zagorski said it should not be viewed as the end point but, rather, part of the journey.

DoubleVerify listed in the stock market in April, raising $360 million, with shares jumping at open.

Investors That Offer Strategic Advice Are Best Partners: DoubleVerify’s Mark Zagorski

“The IPO provided us with lots of capital that we can continue to use to invest and grow on our mission to create a stronger, safer and more secure digital advertising ecosystem,” Zagorski said.

“IPO was a pretty obvious route for us because of what that mission is all about, and that mission is driven by a drive to create greater transparency in the ecosystem. What better way to represent transparency is to go public and make ourselves transparent?”

Special Purpose Acquisition Companies (SPACs) are becoming a popular way to do an IPO. It is “essentially a shell company set up by investors with the sole purpose of raising money through an IPO to eventually acquire another company”, reports CNBC.

It’s how Taboola finally went public this summer, and how AdTheorent went to market in a deal valuing it at $1 billion.

In this video interview with Beet.TV, Nick MacShane, senior managing director at M&A advisory Progress Partners, explains why the route is becoming so popular.

A bigger story

“That is presenting a number of other companies that might not feel they have all the juice to go public a second option to get into the public market,” says MacShane, whose Progress Partners advised on deals including Signal’s sale to TransUnion and RTK’s to Rubicon Project.

In a SPAC, a company merges with an existing entity in a capital plan to grow the return on floatation, aiming to fund future M&A.

What is a SPAC? Explaining one of Wall Street’s hottest trends (via @CNBCMakeIt) https://t.co/KVSlKFwnGQ

— CNBC (@CNBC) January 30, 2021

MacShane says of ad-tech’s public-markets aspirants aspirants: “They may have flattened out, in terms of their growth. They may not have quite the story, the future story that the public market is looking for.

“You’re starting to see some of those companies now poke around and look for add on companies to merge with them, to then bring to market a better story.

“We’re seeing a tremendous amount of activity there with companies really looking for partners.”

M&A is back

All of which is putting ad-tech M&A back on the map.

In recent weeks, Beet.TV alone has written about IAS buying Publica and Mediaocean buying Flashtalking.

The bounce-back was happening before SPAC’s became fashionable.

Even so, it seems the days of investors burned by failed ad-tech IPOs are behind us.

Agile money fuelling M&A

“In the last year or so we’ve had about 10 to 15 companies meaningfully move into the public market,” says Progress Partners’ MacShane.

“What that’s doing is creating a bunch of liquidity, which is giving opportunities for those companies once they go public to think about where they may want to go further to continue to maintain their strength as a public company,” he says. “That’s fueling some acquisitions.”

He credits private equity firms as being more agile and willing to put money into ad-tech than larger institutional buyers, who are “struggling restarting their engines” after COVID-19.

Twelve-year-old Progress Partners has also closed a venture round of its own, having previously invested in the likes of MediaMath and Simpli.fi.

You are watching “Innovation, Leadership, and Value Creation: Strategies Explored,” a Beet.TV leadership series presented by Progress Partners. For more videos, please visit this page.

]]>“I felt there was a big opportunity to create a multibillion-dollar technology company focused on the needs of premium publishers, and that’s exactly what we’ve done,” he said in this interview with Beet.TV.

PubMatic in December went public with a valuation of more than $1.4 billion, and its stock price has steadily appreciated since then.

The IPO marked was a significant milestone for a company that Goel and his business partners started in 2006. In those early days of pitching to investors, about 20 of them declined to participate in the fundraising. Instead of being discouraged, Goel found inspiration in rejection.

“I knew I was onto something that was unique, and there would not be dozens of copycat companies following behind me because investors didn’t understand the concept or opportunity,” he said.

Lessons for Entrepreneurs

Goel has learned a variety of lessons as a technology entrepreneur, including the importance of being financially disciplined. He advises against raising too much money, such as hundreds of millions of dollars before the business has gotten off the ground.

“In many cases, it’s before the company has figured out its core unit economics and things like that,” he said. “That’s a real danger because if you don’t grow into that valuation that’s implied by that level of fundraise, or if there’s an economic cycle between now and your next fundraise, that can be a real handicap.”

Before raising $118 million in its IPO, PubMatic has raised a total of $60 million from private investors, and its last round was in 2012.

He also advises that startups focus on working with individuals at VC firms, rather than seeking investments from those potential partners based on their reputations.

“In reality, you’re going to be working with an individual, a partner who’s going to be on your board,” Goel said. “Their job is to represent the quality of the investment to the rest of the partners in case there’s follow-on investments or time that has to be spent to move things forward.”

Recipe for Success

Goel attributes PubMatic’s success to its focus on its team and company culture. He said company management is transparent about its operations.

“We share a lot of information with our employees, whether it’s good news or not-so-good news,” he said. “We bring everyone into the decision-making process to the extent possible.”

As a provider of technology that processes trillions of bids on billions of ad impressions a day for publishers, infrastructure also has been a key focus for PubMatic. He said the company works to continually innovate in a highly competitive marketplace.

IPO Rationale

Goel’s goal for PubMatic was to be profitable as soon as possible to better “control its destiny,” he said. In considering the possibility of being acquired or going public, he said it was important that potential acquirers understand PubMatic as a technology company.

“One of the challenges in the category is that strategic acquirers have a hard time understanding the companies in this category,” he said. “Being public gives us a level of transparency that creates confidence with those partners to build for the future and to build their business on top of our platform.”

You are watching “Innovation, Leadership, and Value Creation: Strategies Explored,” a Beet.TV leadership series presented by Progress Partners. For more videos, please visit this page.

]]>Last month, we spoke with Mediaocean CEO Bill Wise on his company’s acquisition growth and the opportunities that the company’s owner Vista Partners, has brought. We have republished that interview with today’s news.

Here is our original report on my conversation with Bill Wise for our series on innovation and value creation.

Entrepreneurs benefit when they work with investors at every stage of growth from startup to expansion and diversification. As co-founder and chief executive of advertising software company Mediaocean, Bill Wise has been through steps that have included being acquired by a private equity firm and buying other companies worldwide.

“It’s not a sprint. It’s also not a marathon. It’s a relay race,” he said in this interview with Beet.TV. “You need to know when to hand the baton off, and that’s through every facet of the company.”

Despite the negative effects of the pandemic on the global economy, businesses have many ways to find venture capital. Those sources can include technology entrepreneurs who want to diversify their wealth by investing in promising startups.

“People always say the best time to start companies is in a recession or a downturn,” Wise said. “So, it’s going to be really interesting in the next 12 months how many new startups we see coming out of this.”

Mediaocean has weighed different sources of financing throughout its growth, including the sale to private-equity firm Vista Equity Partners in 2015. At that time, the private-equity market was stronger than the public markets, and Mediaocean had more room to growth before considering an initial public offering (IPO) of stock.

“For us, we needed that next phase of maturation before exploring the IPO markets,” he said. “Who you partner with really matters.”

Acquisition Philosophy

Mediaocean, whose roots go back to the 1960s with Donovan Systems, has been aggressive about buying software companies that Wise once described as “mini Mediaoceans” in other markets. The acquisitions include MBS and Symsys to expand into Europe, and PIN Systems and BCC AdSystems to push into the Asia-Pacific region.

When investing in startups, Wise said he looks for entrepreneurs who are passionate about their businesses and who are willing to change strategies as the market demands.

“I look for that fire in the eye,” he said. “I look for something that’s passion-based.”

A combination of stimulus funding and low interest rates is pushing equity markets to new highs and making stocks expensive compared with their profits. A handful of tech stocks are driving the overall market.

“There’s a sense of irrationality around technology,” Wise said. “Luckily for us in this space, advertising has become a technology-driven business and a software-drive business.”

The rich valuations of adtech companies is giving them more currency for acquisitions. Wise sees a need for a diverse advertising market outside of walled gardens in search, social media and e-commerce.

“We believe the industry needs a neutral and independent operating system,” he said. “There’s too much buy-side technology being driven by Big Tech. Google, Facebook and Amazon are the world’s largest sellers of media. They control too much of the buy-side ad-tech.”

Mediaocean last year acquired 4C Insights to expand into audience analytics and planning, and Wise said he is shopping for other deal targets.

“We think we can continue to consolidate to have a much more holistic offering across every single media type, every single market around the globe,” he said.

You are watching “Innovation, Leadership, and Value Creation: Strategies Explored,” a Beet.TV leadership series presented by Progress Partners. For more videos, please visit this page.

]]>Most recently, he led DoubleVerify through an initial public offering (IPO) of stock to raise $340 million. The company has a market value of about $6.23 billion, based on its current stock price.

“We look at the journey to an IPO as not one in which the IPO was the destination. It was one step on a much longer path towards continued growth over time,” Zagorski said in this interview with Beet.TV. “The IPO provided us with lots of capital that we can continue to invest and grow in our mission to create a stronger, safer and more secure digital advertising ecosystem.”

As a company that seeks to make the digital ad market more transparent by ensuring that real people see ads and not bots, DoubleVerify also aims to build confidence in its business by disclosing its financial performance as a public company, Zagorski said.

Before joining DoubleVerify, he was chief executive of sell-side platform Telaria, which last year completed a merger with Rubicon Project to form Magnite. The deal was another sign of the ongoing evolution of the ad-tech industry.

“It’s always changing, and there’s always a new opportunity for growth,” Zagorski said. “The companies that I’ve been lucky enough to be part of have been…at the forefront of what’s next. That’s what has kept me engaged over all these years.”

Investment Partners

As important as fundraising is to startups, they also need to find solid investment partners that can provide strategic advice when necessary.

“You need capital to continued to grow, but money is, I hate to say it, money’s not easy, but money is plentiful,” Zagorski said. “It’s what comes with that money that’s most important. What you really need to consider is who’s your partner that’s helping you bring those new dollars in, and what are they going to be after those dollars come in.”

The best investment partners are ones that are thinking beyond transactions and about the longer-term growth prospects for a company. That view includes those times when businesses face challenges.

“When times are good, there are lots of people who want to be your friend,” Zagorski said. “It’s those that are going to be there when times get tough, when you need strategic advice, when selling your story isn’t a slam dunk to every investor that you meet. Those are the real partners, and that’s who you should look for as a strategic adviser.”

Outcome-Driven Advertising

The digital ad market is going through a period of upheaval as privacy concerns drive tech companies to end support for tracking technologies like third-party cookies and device identifiers. The shift from people-based measurement will force advertisers to develop other ways to measure engagement in a cross-screen environment.

“The companies that are not only tracking that activity, but learning how to engage with users across all those screens are exciting opportunities for companies like mine who want to partner with them, but also for investors who are looking for growth opportunities,” Zagorski said.

You are watching “Innovation, Leadership, and Value Creation: Strategies Explored,” a Beet.TV leadership series presented by Progress Partners. For more videos, please visit this page.

]]>Farhad Massoudi went through various stages of growth as the founder and chief executive of Tubi, the ad-supported video on demand platform that Fox last year acquired for $440 million. He came up with the idea as advertisers shifted their media spending to digital platforms including social media.

“I thought that TV channels ultimately were going to be replaced with TV apps, and in that process, TV advertising will be completely disrupted,” he said in this interview with Beet.TV. He started a company called AdRise, which evolved into Tubi.

“I have to say, it was really hard to raise money for it,” he said. “In the early days, people didn’t believe TV would be disrupted. The power of the bundle was very strong, and I was told it would never change.”

As Netflix branched out from mail-order DVD rentals and into streaming video, it showed that many consumers were willing to pay for an alternative to cable and satellite TV by offering a quality viewing experience.

“When Netflix proved them wrong, I was told that subscription video on demand was the way to go – so, a lot of naysayers both in Silicon Valley and in Hollywood about ad-supported video on demand,” Massoudi said.

Advice to Entrepreneurs

He initially raised about $400,000 from friends and family to get his company off the ground, and later found a venture capital fund that led a financing round of $2 million-$2.5 million. Massoudi recommends that entrepreneurs dream big when they’re pitching their business to investors.

“It has to be a big idea, a multibillion-dollar idea, because otherwise, you’re not going to attract the right VCs,” Massoudi said. “Even if you do, you’re going to disappoint them. Financial models are such that they need huge exits.”

He said Tubi was working on a plan to go public, but the growth in AVOD services started drawing interest from major media companies like Fox. Before the deal with Fox, Viacom had acquired Pluto TV for $340 million in 2019, while Comcast acquired Xumo for more than $100 million.

Massoudi said Fox’s purchase of Tubi has given the platform access to more resources for growth.

“It made sense to use the muscle and the power of a larger media company that’s very sophisticated in this space to help better our products, our offering and our business,” he said.

You are watching “Innovation, Leadership, and Value Creation: Strategies Explored,” a Beet.TV leadership series presented by Progress Partners. For more videos, please visit this page.

]]>Its shares trade under the symbol “TBLA” on the Nasdaq following a deal to be acquired by a special purpose acquisition company (SPAC) — a publicly traded shell company whose sole purpose is to buy a private company.

“We’ve been wanting to be a public company for a while,” Adam Singolda, founder and CEO of native advertising and content discovery platform Taboola, said in this interview with Beet.TV. “We thought we had the financial performance investors would appreciate. We want to champion the open web.”

The “open web” refers to ad-supported websites outside of the “walled gardens” of social media, internet search and online marketplaces – namely, Facebook, Google and Amazon. The total size of the advertising market on the open web is estimated at $60 billion.

Taboola reported revenue of $303 million and net income of $18.6 million for the first quarter of this year. Last year, it generated $100 million in adjusted earnings before interest, taxes, depreciation and amortization (Ebitda) on $1.2 billion in revenue, Singolda said.

Changing Needs for Financing

Like other startups, Taboola has financing needs have stages of seed funding to possibly being acquired or going public. Taboola has experienced these phases of growth since Singolda came up with the idea for his company 13 years ago. At that time, he found an angel investor who listened to his pitch for creating a service to provide recommendations on what to watch on TV. Taboola gradually added staff, but also experienced early growing pains.

“I almost shut down Taboola three times for having no funding,” he said.

His search for funding in 2011 led him to Sand Hill Road, the famed epicenter of venture capital near Stanford University. He met 30 investors, all of whom declined to provide funding, and eventually found a new fund in New York that invested $1.5 million in Taboola.

“That was the last money we ever needed,” Singolda said. “We turned from that moment in 2012 from generating hundreds of thousands of dollars in revenue to over $20 million in in revenue 2014, and over $1 billion in 2020.”

The SPAC financing will help Taboola to expand into providing recommendations for any kind of product — not just publisher content. Singolda also sees the possibility to serve recommendations on any device, including connected TVs.

“There’s an opportunity to transform the open web into a feed of recommendations,” he said.

You are watching “Innovation, Leadership, and Value Creation: Strategies Explored,” a Beet.TV leadership series presented by Progress Partners. For more videos, please visit this page.

]]>When Simpli.fi was getting started, investment bank and corporate advisory firm Progress Partners “was very active in helping us in the early, formative stages of the company – giving us introductions, et cetera,” Prioleau said in this interview with Beet.TV.

Simpli.fi later raised growth capital in a funding round with Frontier Growth, which provided advice on how to focus on key metrics used by software as a service (SaaS) companies, such as net recurring revenue and Net Promoter Score (NPS). In 2017, Simpli.fi’s investors considered the possibility of finding a strategic buyer for the company. That year, it was acquired by Chicago-based private equity firm GTCR, setting the stage for the next phase of growth.

“Selling to private equity was a great fit for us, because we really believed in the company and wanted to participate in the company in a meaningful way going forward,” Prioleau said. “When you sell to private equity, you’re really going into partnership with that private equity firm.”

The ad-tech industry went through a period of rapid growth as the buying and selling of digital advertising migrated to automate auctions. Some ad-tech companies went public, only to disappoint investors.

“The markets have had a love-hate relationship with the ad-tech industry. Early on, there were some companies that went public and didn’t perform well in the public markets,” Prioleau said. “More recently, the industry has matured. We’ve got great companies out there like The Trade Desk who have shown that ad-tech companies can be good public companies.”

Prioleau recommends that entrepreneurs seek out early-stage investors that can provide expertise on developing a growth strategy, whether it’s through organic sales or acquiring other companies.

“For people starting out, the quality of the partnerships is really important. We’ve been super-fortunate to have great partners all the way from the seed stage, the growth stage and now in the private equity stage,” he said. “We were focused on being profitable fairly early, so when we went to raise money, it was really because we wanted to raise money to fund growth initiatives. It wasn’t because we needed to raise money to fund losses.”

Blackstone joins GTCR as majority shareholders in Simpli.fi, whose connected TV and mobile programmatic advertising platform handles more than 120,000 campaigns for 30,000 active advertisers every month, according to the deal announcement.

Blackstone’s investment will help to accelerate Simpli.fi’s innovation and organic growth initiatives, and continue its targeted acquisition strategy. Blackstone’s investments in digital advertising technology platforms also include equity interests in Liftoff and Vungle.

“Simpli.fi’s highly differentiated technology platform and superior customer service have made it a clear leader in its space,” Sachin Bavishi, managing director at Blackstone, said in a statement. “Digital advertising is a high-conviction investment theme at Blackstone and Simpli.fi sits at the intersection of multiple attractive tailwinds, including the continued shift in local media spend to programmatic digital and CTV.”

You are watching “Innovation, Leadership, and Value Creation: Strategies Explored,” a Beet.TV leadership series presented by Progress Partners. For more videos, please visit this page.

]]>That is what seems to be happening with internet-connected T right now – and that’s what is happening for Innovid, too.

The ad delivery and measurement platform for connected TV has been working in the area for 14 years. Now, with the CTV waves crashing ashore, it is going public to raise $403 million in a deal valuing the business at $1.3 billion.

In this video interview with Beet.TV, Innovid co-founder and CEO Zvika Netter says the company’s vision never swerved, and he wanted to quickly capitalize on CTV’s COVID-era growth curve.

Visible vision

“(We aim to) support the growth of the company, (so that) our clients and our partners could see that and not think, ‘These guys raised all this money and they’re going to sell it to some big tech firm and move to Bora Bora’,” Netter says.

“We’re here to work and really change the future of television for many years to come.

“Now I think everybody will understand that this is we’re here to stay for a very long time and why it’s the right route for us.”

Deal structure

Innovid’s software automatically uploads and encodes advertising creative to stream ads to any screen or device, manages the physical delivery of ads and measures performance across the MRC-accredited metrics, connecting together a host of demand- and supply-side platforms, publisher apps and CTV devices.

It claims 40% of the top 200 US TV advertisers as customers.

According to The Wall Street Journal: “Innovid is planning to raise $403 million through a roughly $150 million private investment in public equity, or PIPE, at $10 per share, and $253 million from a special-purpose acquisition company (SPAC) called ION Acquisition Corp. 2.”

The company had taken a reported $95.1 million over eight funding rounds since 2008.

Going quickly public

After the earlier cooling-off in, ad-tech public listings are back in fashion after the pandemic revealed continued growth in key trends like online consumption and CTV ad capabilities.

PubMatic, Viant, AppLovin and DoubleVerify all recently went public, with Sprinklr and Integral Ad Science to follow.

“COVID was a delay – it’s a curse and a blessing in a way,” Innovid’s Netter says. “In Q2, we suffered like everybody else.

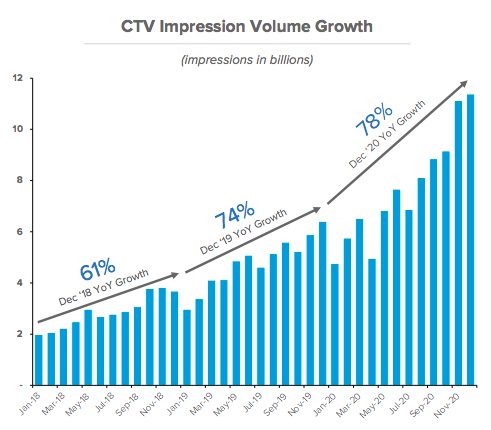

“But, very fast, we realised that the consumption of CTV, as everybody knows, is growing dramatically starting May and June of last year – and it’s never stopped.

“We waited for the presidential election to be over. We waited for the vaccines. We wanted to see that this is here to stay at scale. Once we saw it, we said, ‘Okay … we want to go and we want to go (public) very fast’.

“The SPAC allowed us speed. It was a way to lock this deal in a very high speed and be public, be out fast.”

CTV growth forecast

In May, eMarketer predicted 2021 US CTV ad spending would hit $13.4 billion.

The markets are realizing that linear TV consumption and classical pay-TV are unlikely to be resurrected, but that TV advertising generally remains effective.

So companies like Innovid are warming advertisers up to the idea they can deliver targeted, digital-style ads, with precision measurement, to TV-like devices. It’s a best-of-both-worlds strategy.

Innovid’s projections

Innovid wants a piece of an estimated $20 billion global CTV ad business, within a $200 billion global TV ad industry.

It projects its revenue growing from $69 million in 2020 to $177 million by 2023, 63% of it from CTV.

And Innovid boasts high customer retention, retaining 94% of core customers last year.

But it plans to double its operating expenses by 2023.

You are watching “Innovation, Leadership, and Value Creation: Strategies Explored,” a Beet.TV leadership series presented by Progress Partners. For more videos, please visit this page.

]]>