“We are helping advertisers and publishers understand where their consumers go, and essentially be able to target and measure the effectiveness of advertising on CTV,” Glen Straub, vice president of business development at location data platform Foursquare, said in this interview with Beet.TV. Foursquare is the preferred attribution platform for Tubi, the ad-supported video on demand (AVOD) service.

“Any one of their advertisers can leverage Foursquare’s lift methodology to understand the effectiveness of campaigns across the Tubi platform,” Straub said. “We have a strong partnership across all of their advertisers.”

Foursquare gathers location data through its owned-and-operated apps, such as City Guide and Swarm, and third-party apps that run its Pilgrim SDK (software development kit) from consumers who have consented to share anonymized information.

“We have the industry’s only first-party panel in location attribution,” Straub said. “We’re able to understand — fully opted-in — where people go in the physical world relevant to Foursquare’s POI, or places data. We then match those signals to ad exposures. In the case of Tubi, coming across the entire network anytime a campaign is run.”

Foursquare uses multiple identifiers for location data, lessening the dependence on audience tracking methods like Apple’s identifier for advertisers (IDFA). The tech giant last month updated the software that runs devices including the iPhone to ask customers for permission to share identifiers with apps and websites. With many people not consenting to share their device IDs, audience tracking is expected to become more difficult.

“It’s definitely a challenge across the industry, most notably in anyone who is rooted in mobile, which Foursquare always has been. The mobile advertising ID has been the cornerstone of everything that Foursquare does within the advertising ecosystem,” Straub said. “However, we have evolved. We observed this happening way before Apple made its announcement late last year. We’re able to provide our tools across multiple identifiers, working with whatever the advertiser or publisher has and needs. We have the ability to understand even CTV IDs.”

You are watching, “The Stream: New Audiences, New Opportunities,” a Beet.TV leadership series presented by Tubi. For more videos, please visit this page.

]]>That’s the theory. The truth is, behind the scenes, a veritable spaghetti soup of systems is required to make the dream a reality.

In this video interview with Beet.TV, Stacy Daft, GM, Enterprise Commercial Business Development at Amobee, describes why equal, cross-channel sales is so complex, and how it can be fixed.

Seller centralisation

“They’re dealing with legacy platforms that are on the linear side of the house,” Daft says. “They’re disconnected from the digital platforms. And neither one of them really has an awareness of the other – yet, there’s still a need to monetize the full portfolio and maintain budgets that traditionally could be met on linear channels alone.

“So, ultimately it leads our clients looking for technology to reunify and package their inventory

“This leaves media companies with a unification problem, really – how do they pull together a full view of their inventory across all linear and digital distribution channels, regardless of that consumption platform?

“And it makes monetizing the content even that much more complex because they don’t have a centralised place to understand how their audiences accumulate across the different screens, much less have an ability to optimise for a specific client’s KPI across their full portfolio.”

Buyer beware

But it isn’t just the sell side that is facing complexity when embracing the new opportunity that lies inside proliferation. Ad buyers, too, are interested – but confused.

A recent study, Era Of Addressable, carried out by Forrester, found the buy side calling for change:

- Simplify buying and managing campaigns across suppliers (66%)

- Increase scale (65%) and national footprint (64%)

- Interoperability among MVPDs (74%); technology partners (93%)

- Single measurement standard from media companies (92%)

Daft feels their pain.

“When you think about the addition of CTV and more streaming services and premium TV quality content moving digitally, there’s a desire to not lose the data and the effectiveness of targeting in the digital environments,” she says.

“But most importantly, make sure that that is done in conjunction with the planning that they’re doing across their linear portfolios as well, so that they can maintain and understand total reach across their investments, whether or not it’s linear, digital, CTV, and what portions of those investments or what portions of their audiences are being reached in which environments and how incremental is the addition of new channels to their holistic buy.”

Viewers’ experience

Smoothing out that complexity matters to more than just media owners and advertisers.

Kinks in this chain can degrade the viewer experience.

“Sellers have the opportunity to use that targeting and the premiums that come along with providing optimization and better targeting across their portfolios to reduce ad loads,” Daft adds.

“This is something that’s also desirable by brands. They themselves have a stake in the consumer experience.

They don’t want to be repetitive and annoying, similar to media companies, in terms of how they want to satisfy their clients as they compete for the eyeballs across the various distribution channels today.”

You are watching, “The Stream: New Audiences, New Opportunities,” a Beet.TV leadership series presented by Tubi. For more videos, please visit this page.

]]>“So much of viewership is about microtargeting — especially over the past 12 months,” Adam Lewinson, chief content officer of Tubi, said in this interview with Beet.TV.

Whereas people used to watch the same shows and have water-cooler conversations about them the next day, they now seek more individualized programming and turn to social media for those discussions about their favorite shows.

“What you stream is who you are,” Lewinson said. “If you show me your queue , that’s going to tell me a whole lot about who you are, what genres you want to watch.”

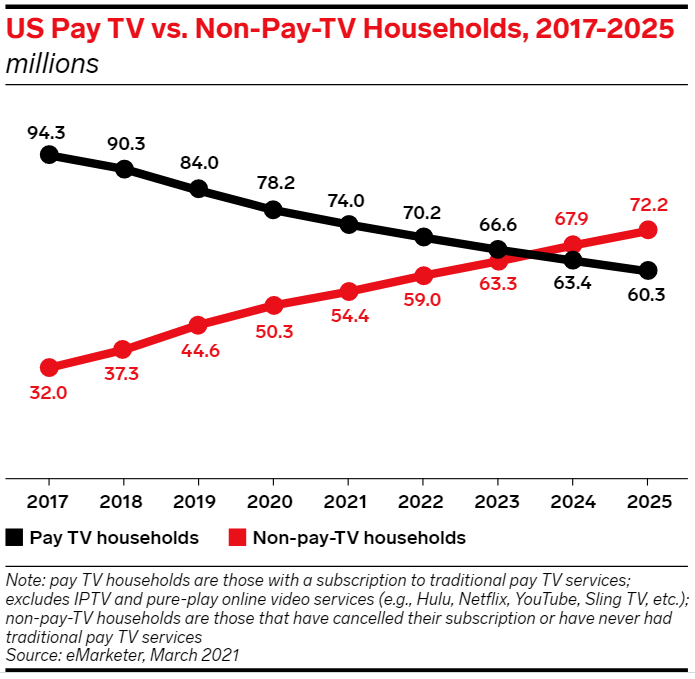

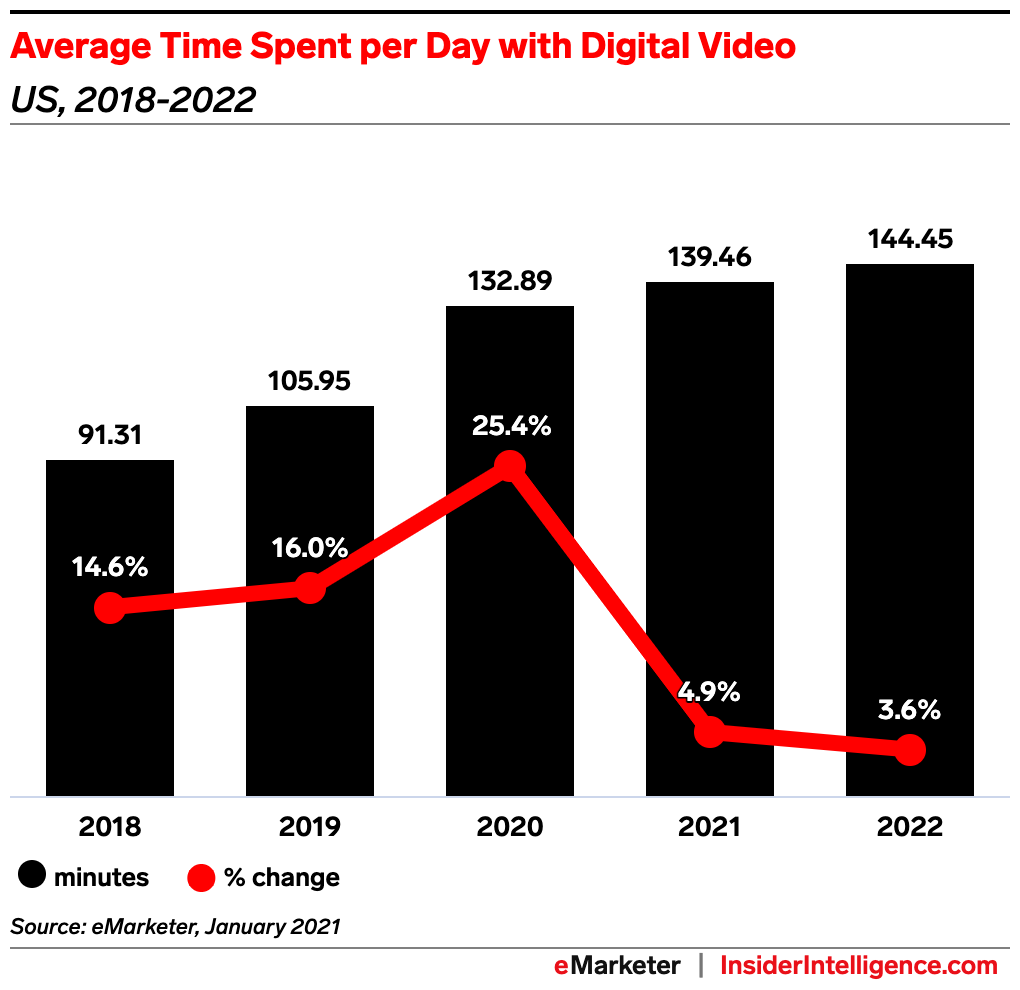

Source: eMarketer

To meet the needs of those audiences, Tubi has built a content library of more than 30,000 titles, and created tools to help people discover programming that appeals to their interests. Tubi plans to differentiate its platform even further by adding 140 hours of original content this year.

“Our original strategy is going to mirror that by creating content that has our viewers and our advertisers top of mind,” Lewinson said.

Tubi’s range of programming includes everything from thrillers to westerns to romantic comedies to children’s shows. Viewers can find content grouped by genre or in special collections, such as Black Cinema.

Tubi also is expanding its news programming with local news from Fox TV stations, and has a goal of being in 58 designated market areas (DMAs) this year. As part of Fox’s broadcast deal with the National Football League, Tubi will expand its sports programming even further. Tubi also plans to expand its documentary programming, and offer more animated content as part of a deal with animation studio Bento Box.

“We’re using content intelligence,” he said. “We have so much data now about our viewers’ behavior, about their interests, about their needs and we’re using that to fuel decisions about what content we want to make.”

You are watching, “The Stream: New Audiences, New Opportunities,” a Beet.TV leadership series presented by Tubi. For more videos, please visit this page.

]]>A year ago, as the pandemic bedded in, ad buyers were holding on to their money, pushing it down the marketing funnel and calling for a delay to the upfronts, the traditional annual season in which TV and video networks pitch for advance ad spending commitments.

Fast-forward to May 2021 and, whilst pandemic economic effects have far from disappeared, a few circumstances are coalescing to make the Upfronts and IAB NewFronts a little different.

The new fronts

- Ad-supported VOD (AVOD) offerings have become bona fide operators.

- TV networks are cross-selling their traditional channels with their own-brand AVOD services.

- Live sports has returned.

- Production has resumed on many shows.

- The vaccination outlook is giving brands more economic optimism.

In this video interview with Beet.TV, Jay Prasad, chief strategy officer for TV at ad-tech company LiveRamp explains why this time it is different.

CTV trends up

“Last year, you know, I don’t even think Peacock was launched yet, Discovery Plus wasn’t out yet, Paramount Plus in its combined form wasn’t out yet,” Prasad says.

“So this is now the first year with all these massively built-up platforms that are owned by the traditional TV media companies that are being combined with a return to normal in live linear with sports.”

Prasad thinks the emergence of the new, network-backed AVODs, plus increasing advertiser appetite for a new kind of media buy, will drive adoption of connected TV (CTV) advertising.

“I think this year’s upfronts are very much going to be focused on what the opportunities are for marketers to really embrace the platform,” he says. “Not just because it’s like digital – it’s because it has unique content experiences, viewing experiences, interactive and creative ad units that don’t exist in traditional TV.”

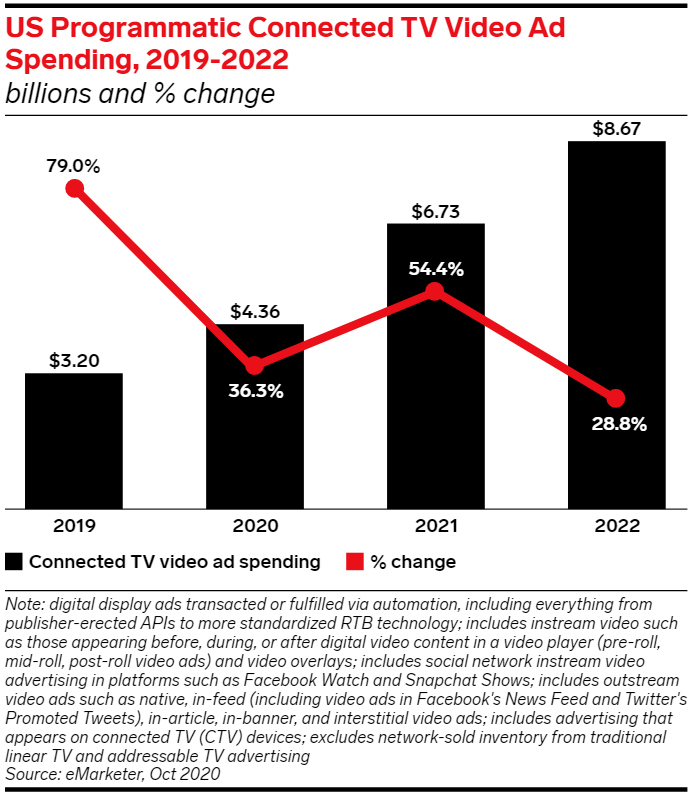

Over half (54%) of US digital media professionals naming it a leading priority for 2021, per an October 2020 survey by Integral Ad Science.

EMarketer estimates that US CTV ad spend will grow even faster this year than last, up 48.6% year over year (YoY) to $13.41 billion.

New tricks

For Prasad, it’s all about the new capabilities of connected TV.

“A lot of brands that are leaning in with cross screen measurement are able to understand who they’re actually reaching and how often on linear, and then being able to look at audiences and not just demographics,” he says.

“And then there is, of course, the ability to do a lot more audience related profiling targeting, and then measurement becomes something that is a lot more close to real time than we’ve had in the past with TV.

“A brand like Tubi, when it’s creating a customer accounts, it does have an idea of who’s watching. That’s the only way you can create customised playlist and surface recommend viewing and things of that nature.

“So that identity has to be able to work with a brand’s identity or a agency holding companies identity. And that’s the only way that you can get targeting and data to be able to move around.”

You are watching, “The Stream: New Audiences, New Opportunities,” a Beet.TV leadership series presented by Tubi. For more videos, please visit this page.

]]>“We know that AVOD is continuing to grow not only with the younger millennial audience, but the older demographics as well,” Randi Leonard, director of advanced video investment at Haworth Marketing + Media, said in this interview with Beet.TV.

Her clients in the retail, spirits and home improvement categories all have added AVOD platforms to their media mix. AVOD provides targeting and the ability to measure ad viewing, though it’s more challenging for marketers to measure whether they’re reaching different audience than through linear TV, Leonard said.

“The biggest thing for us is really understanding the video landscape holistically, and using as much data as we can,” she said. “The first-party data is really important. We work with a lot of third-party data providers as well, to hone in on our custom audience to really determine where our ideal customers are.”

‘Ad Load Always Important’

Automatic content recognition (ACR) data from smart TVs provide insights to help marketers in their competitive conquesting campaigns, and to know when to decrease linear activations to avoid excessive ad frequency.

“Ad load is always important. We don’t want to be muddled in a pod of 15 other advertisers,” Leonard said. “I would say frequency is actually more important, especially with certain AVOD players. We’ve all been watching streaming services where we’re seeing the same ads over and over and over, and it almost has an adverse effect on the viewer. That’s something we’re really monitoring across all of our partners to make sure we have stringent frequency caps in place.”

AVOD also provides opportunities for programmatic buys of inventory that may not be available in direct deals.

“The biggest factor that we’re looking at for direct buys versus programmatic is the transparency and also if there’s any value-added opportunities or attribution studies that we’re looking into,” Leonard said. “If we’re just looking at reach and we’re trying to cast as wide a net as possible, programmatic is obviously the way to go.”

You are watching, “The Stream: New Audiences, New Opportunities,” a Beet.TV leadership series presented by Tubi. For more videos, please visit this page.

]]>“We look at AVOD as part of the whole from a video perspective — a holistic video approach,” Lisa Herdman, senior vice president and executive director of strategic investment at ad agency RPA, said in this interview with Beet.TV. “We all know that linear impressions are decreasing, but it really is a migration from one way of watching video to another way.”

Her agency looks at AVOD services as a way to add incremental reach to linear media channels that currently have greater scale.

“We definitely go through a massive education process on a daily basis, because as everybody knows, there’s a new streaming service popping up every other week, which is the good news,” she said. “The expectation for AVOD is to be the extension of linear.”

‘Good Buy-In’

Advertisers and their agencies want to learn more about the programming on AVOD services, along with information about their reach, subscribers, ad load and measurement.

“We have a really good buy-in that …consumers are watching premium video, they’re just watching it differently,” she said. “We’ve used premium video and that viewership for big brand pushes, awareness, launches. The expectation is for AVOD to continue to carry that torch.”

Source: eMarketer, Insider Intelligence

Audience data play a crucial role in helping to determine whether advertisers are achieving incremental reach.

“Putting couple of layers on top of an age and demo is a really great way to be additive to what we’re currently doing with linear video,” Herdman said. “Data is more important than ever in the video world, and it’s more available for video, especially in linear, but of course for the AVOD perspective, too.”

Engaging Advertising

Many consumers have demonstrated their preference for less commercial interruptions by subscribing to ad-free services like Netflix, Disney+ and HBO Max that don’t carry advertising. However, many viewers also are watching AVOD services that are free and have a smaller ad load than linear TV, giving advertisers a way to stand out.

“There’s a positive and negative there that needs to be weighed. We’re still learning to work with…more engagement-type advertising on these streaming services,” Herdman said. “There’s a ton of opportunity. We just need to see what works best for each client individually.”

You are watching, “The Stream: New Audiences, New Opportunities,” a Beet.TV leadership series presented by Tubi. For more videos, please visit this page.

]]>“When we look at a lot of the shifts we’ve seen with covid, AVOD is a huge piece of the puzzle for us in terms of how we plan our overall TV/video mix,” Erika Newsom, vice president of strategic and integrated planning at Camelot Strategic Marketing & Media, said in this interview with Beet.TV.

Because AVOD services are free to consumers, they have emerged as a viable alternative to subscription-based video-on-demand (SVOD) platforms like Netflix, Disney+ and HBO Max that charge fees for an ad-free experience. Viewers have more choice and control over what they see on connected devices like smart TVs and mobile phones.

“Most of the consumer growth that you’re seeing in AVOD and SVOD is driven by programming, and it’s driven by content and storytelling,” Newsom said. “All of the major players in the space are making big investments around content right now. Whether it’s Tubi leveraging that Fox catalog that they have access to, and then moving into original programming, or it’s Roku with their brand studio investment, or any of the players — they’re all investing in content.”

While the audience for that programming is growing, marketers face challenges in reaching target consumers as data privacy becomes a bigger issue. Regulations in several regions are giving people more control over their personal information, and technology companies like Google and Apple also are taking steps to limit data sharing.

“As we have limits around some of the data targeting, and/or we have to be more creative around some of the limitations, contextual is going to become en vogue again, whereas it hasn’t been much of a factor for a lot of folks in a while,” Newsom said. “Things as simple as brand integration or sponsorship or how you align with that content rollout in those key events, whether it’s traditional events and tent-poles or more program-driven events in terms of binge opportunities, that’s a whole piece of the puzzle that I think people are revisiting more.”

‘Holy Grail’ of Unified Identifier

Many marketers and media owners have prepared for the limitations on sharing of third-party data by developing their own sources of first-party data, which are gathered directly from consumers. However, the “Holy Grail” of a unified identifier that helps to track audiences among different devices and media channels, while also protecting privacy, is still out of reach, Newsome said.

“Brands and media companies that already have positioned themselves really well from a first-party data standpoint are going to reap even more benefit,” Newsom said.

Marketers want their brands to stand out amid a cluttered media environment. They also seek targeted reach and a reduced ad load that helps to improve the viewer experience.

“If you look at the fact that we’re seeing declines in time spent with ad-supported media…and if you look at CTV more broadly, there’s a large chunk of consumers who are opting into that SVOD experience,” Newsom said. “What’s motivating that is really ad fatigue, etc., and it’s a sub-segment of the consumer audience that can afford those subscriptions.”

SVOD, AVOD Can ‘Play Together’

She said she expects consumers to reach a point of “subscription fatigue” where they’re unwilling fork out more money for another SVOD service, and will be more choosy about which subscriptions they keep.

“There’s definitely opportunity for SVOD and AVOD to play together, but how we think about ad load, in general, and how we think about calibrating that will be changing over the next few years,” Newsom said. “There is probably content that can be monetized at a level that permits less clutter.”

Digital “walled gardens” like Google, Facebook and Amazon also are challenging marketers to find ways to reach unduplicated audiences since they each have their troves of consumers data.

“We used to have this utopian ideal about what the marketplace might look like, and the reality is there are a few key players that have a major stake in controlling their environment and controlling their inventory and their data,” Newsom said. “That concentration will continue, and platform-specific metrics and measurement will continue to be a reality for most of us.”

She would like to see the development of industry standards that help to provide more insights about consumers and their viewing habits.

“That’s part of the reason that algorithms will never completely replace us,” Newsom said. “There is that need for us to understand individual and distinct data points, and to be able to pull those together and synthesize them into an overall strategy.”

You are watching, “The Stream: New Audiences, New Opportunities,” a Beet.TV leadership series presented by Tubi. For more videos, please visit this page.

]]>“There’s a lot of value that advertisers have in combining some of their linear TV buys with these AVOD buys,” Marco Parente, senior vice president of product management at market research giant Kantar, said in this interview with Beet.TV. “The audiences that are using AVOD are new and different audiences, and there’s very little duplication with TV.”

The viewing sessions of AVOD services tend to be longer than for linear TV, with consumers more likely to binge-watch multiple episodes of their favorite shows or to stream movies on-demand. Meanwhile, AVOD services tend to reach younger audiences than traditional linear TV, he said.

In addition to media fragmentation, marketers also face greater challenges in ensuring that their advertising campaigns are having a measurable effect on business outcomes. Measuring that effectiveness is expected to become more difficult as technology companies take steps to limit audience tracking.

“You can’t have a discussion today about anything related to ad-tech or measurement without acknowledging the state, or the future state, of identity in the industry,” Parente said. “It’s a huge challenge because it underpins pretty much all of how the ad-tech ecosystem operates today.”

Google next year plans to end support for third-party cookies, a popular tracking technology, in its popular Chrome browser that serves as a gateway to the internet for hundreds of millions of consumers worldwide. Apple already took similar measures with its Safari browser, and soon will ask its customers to give permission to apps that want access to device identifiers used for tracking.

These changes will make cross-screen measurement more difficult, and possibly limit the ability to determine which channels are most effective for advertising.

“Marketers need to understand how the same consumer is being exposed to media across channels and across screens,” Parente said. “With data deprecation, the ability to do this becomes even more challenging because we’re losing more signals in the form of device IDs.”

Different Data Sets

Another key challenge is combining data sets from digital and TV, which may not be comparable because of different methods of gathering and measuring data. Digital measurement can be more granular by tracking consumers on devices like smartphones, tablets and computers, while linear measurement typically is at the household level.

“There will be more dependencies on panels and first-party datasets overall,” Parente said about how marketers will respond to the deprecation of tracking methods.

Another difficulty is tracking audiences among different “walled garden” environments such as Google, Facebook and Amazon. Each company has a massive trove of proprietary consumer data, but it’s not clear how much overlap there is among those groups.

“Including measurement of walled gardens in a holistic way will only become more difficult because the marketer will have to be ready to move their first-party data into multiple environments that don’t talk to each other,” Parente said. “There are solutions currently being tested that make this process easier, like cleaning rooms and secure computation approaches, but these solutions will require that the walled gardens participate.”

Moving to Prescriptive Analytics

Kantar sees greater value in data analytics that are more predictive in determining the likely outcome of ad campaigns and other efforts to boost the value of brands.

“We’re challenging our clients to move beyond descriptive analytics, which is still important because it tells a marketer how effective their campaign was, but it’s still backward-looking,” he said. “We’re moving our clients toward prescriptive analytics. It’s more forward-looking because it tells a marketer what to do to maximize their media investments.”

Prescriptive analytics include evaluations of how well ad creative helps performance, rather than focusing only on a media placement, he said.

“Creative is one of the largest pieces to consider,” Parente said. “A bad creative makes media work much harder.”

Measuring incrementality, such as evaluating the percentage of conversions that resulted directly from an ad campaign, is an important piece in the marketing puzzle.

“A large portion of marketer’s baseline sales is being driven by long-term brand equity,” Parente said. “A marketer not only needs to measure this, but they need to nurture and invest in their brand equity.”

You are watching, “The Stream: New Audiences, New Opportunities,” a Beet.TV leadership series presented by Tubi. For more videos, please visit this page.

]]>“We’re in a hypergrowth stage in terms of the transition that consumers are having to streaming,” Adam Gerber, global chief media officer at Essence, a unit of WPP’s GroupM, said in this interview with Beet.TV. “We’re seeing acceptance of the ad-supported model, which is promising, but we’re still in the infancy in terms of understanding how best to leverage the opportunity from a marketing perspective as the TV marketplace changes so quickly.

Gerber, whose background includes work on the sell-side of the media industry, including more than six years at Disney ABC Television Group, said he’s not surprised by programmers’ different strategies to reach consumers.

“It’s clear that consumers have been enabled by technology, and access to watch on their own time. They want things on demand, and they want aggregated offerings of large swathes of content. The move to streaming services was something that was going to have to happen.”

Shift in Consumer Expectations

He predicted that most scripted content will be on-demand through streaming platforms, while live linear TV will continued to different itself with sports and news. The popularity of streaming platforms that don’t carry advertising, such as Netflix and Disney+, is worrisome for marketers that seek to reach those audience, he said.

Source: eMarketer, Insider Intelligence

“There’s no question that the streaming services are cannibalizing the ad-supported environment,” he said. “That’s a problem for marketers, but it’s not unexpected. As an industry, we’ve not kept up with consumers in terms of the advertising experience they expect.”

Gerber would like to see media outlets work on improving that experience, and not be limited to traditional ways of grouping ads into commercial breaks. He’d like to see more advertising that’s less intrusive to viewers who have greater control over what they watch.

“There are a tremendous number of ways that we can reimagine and re-explore innovation on the ad format front in an AVOD environment,” he said. “I’m continuously shocked we’ve maintained a pod and multi-ad position model, and assumed that that’s how we need to move forward.”

Gerber anticipates that the upfront season will mark a significant change in ad inventories, including those of AVOD services.

“The supply that has existed historically is not going to continue to exist in the same ways and in the same environments that it has,” he said. “There is a very swift shift to streaming. We have to re-think our models. We have to ask our sell-side partners to shift their business models to enable buy-side decisioning to become a reality at scale.”

You are watching “The Stream 2021: New Audiences, New Opportunities,” a Beet.TV leadership series presented by Tubi. For more videos, please visit this page.

]]>Advertisers are “looking for where we can basically scale outside what’s happening in the overall video space. With the linear ratings eroding, how do we find our consumer and audiences on other platforms?” Cara Lewis, executive vice president and head of U.S. investment, Dentsu at Amplifi USA, said in this interview with Beet.TV. “With an AVOD, you can definitely do that across all of the different vendors that are out there.”

The VOD market is evolving quickly as some subscription video-on-demand (SVOD) services also have ad-supported tiers that are less expensive or free to consumers. Either way, consumers have more choices than before.

“It’s the consumers following the content,” Lewis said. “If the content’s there, we can be there.”

Source: eMarketer

Amplifi uses a people-based identity and data platform called M1 that provides consumer insights and addressable targeting opportunities for personalized media and creative strategies at scale. The tool plays a key role in media plans for targeting audiences that are difficult to reach through linear TV.

“We still want to buy incremental reach, which is definitely where our tool comes into play,” Lewis said. “We can plug in the different AVOD partners. As long as we input into it some sort of CPM that we can guarantee against.”

More personalized targeting helps to lessen the ad load on AVOD platforms, with a goal of improving the viewer experience by avoid repetitious commercial breaks.

“It’s definitely nice to see a lower ad load. We just did our ‘Cable Clutter Report’ and to see the amount of ads that are actually still in those reports is pretty astonishing,” Lewis said. “Consumers aren’t necessarily looking to avoid commercials. They don’t mind commercials, but they want them somewhat personalized to them.”

AVOD platforms also provide more opportunities to buy programmatically, though Lewis said she avoid open exchange bidding because of the worries about ad fraud. She prefers private marketplaces (PMPs) that have a select group of video outlets or direct deals.

Advertisers also are looking for improved media measurement to see a more complete view of consumers and their media consumption habits.

“We’re definitely looking to continue the conversations and continue investing against business outcomes where we can for the clients that are ready to do that,” Lewis said. “The big thing is getting that cross-screen measurement set, which I know is a little bit far away, but making sure that we can do that in the ecosystem of holistic video.”

You are watching “The Stream 2021: New Audiences, New Opportunities,” a Beet.TV leadership series presented by Tubi. For more videos, please visit this page.

]]>Well, after an explosion of new services and a tsunami of viewer adoption, that has changed.

In this video interview with Beet.TV, Tim Sims, chief revenue officer of The Trade Desk, says CTV has crossed the threshold.

CTV’s tipping point

Marketers face a dramatically different TV landscape in 2021. Read our report for insights on what this means for the future of TV advertising. #FutureOfTV https://t.co/fgSzw0HAqj

— The Trade Desk (@TheTradeDesk) March 23, 2021

Sims says the pandemic in 2020 “accelerated a few years of change into about a nine-month period”, during which consumers embraced a new wave of ad-supported VOD services (AVODs).

“We saw a huge influx of inventory come into the programmatic media ecosystem,” he says.

“That has really put connected television and programmatic really perfectly aligned for the moment in time that we’re in right now today.”

‘Bigger than linear’

Sims can quantify the development, and the numbers tell him CTV’s footprint is now as big as regular TV’s.

“We see 87 million households on our cross-device graph,” he says. “We’ve reached this equilibrium point where, in connected television, you can reach as many households as you can in linear television.

“It’s kind of mind-blowing to think about that. That’s just an amazing milestone.”

“That myth that, ‘Hey, there’s no scale and connected television’ is completely gone at this point. I think we’ve crossed this tipping point into in CTV now where it’s just becoming a core part of any marketers media plans.”

AVOD boost

Tubi Projected to Be $1 Billion Business and a “Core Pillar” for Fox

By as early as July 2020, The Trade Desk reported CTV ad spending was up by 100% from a year earlier.

Its stock price has been motoring through the pandemic as a result.

The ad-tech firm is benefitting from new services like Tubi, Pluto, Peacock and HBO Max, Sims says.

Spending follows

He thinks those two factors combined – swollen consumer interest plus the scale brought by new services – is combining to beckon marketers in.

“I think that shift that we’ve seen on the consumer side from a media consumption perspective is now going to be followed by a shift in advertising dollars that will move more rapidly into these AVOD services than it has in years past,” Sims says.

“I’m really excited for the future because I think CTV creates one of the greatest opportunities in the history of marketing.”

You are watching, “The Stream: New Audiences, New Opportunities,” a Beet.TV leadership series presented by Tubi. For more videos, please visit this page.

]]>Not just targeting but also fine-grain measurement of the kind that TV advertisers never had before.

That is according to one tech executive who helped a US supermarket chain use CTV to great effect.

Win-win for Winn-Dixie

In this video interview with Beet.TV, TVSquared president Jo Kinsella says her company recently helped southern supermarket operator Winn-Dixie and its media buying agency USIM deploy a campaign over Tubi, the ad-supported video-on-demand (AVOD) service.

“They actually didn’t believe that people were going to their website, they didn’t believe that there was going to be any website visitation at all,” Kinsella says.

“Initially, they weren’t actually interested in attribution, they were just interested in reach and frequency.”

But Kinsella says the results, which came after the team used TVSquared’s ADvantage XP to leverage a reach extension over and above linear TV and using frequency-cap reporting, were “amazing”:

- “We were able to show 79% net new households were reached by Tubi over and above what they’d reached in linear.”

- “What was staggering for the Winn-Dixie folk is that 54% of exposed audiences visited the grocer’s retailer site.”

- “Because we can see new visitors, we can see returning visitors, we can see them leaving stuff in the cart, we can see them coming back and converting… they were able to get really deep into the analysis in terms of what worked and what didn’t work.”

Spending forecast

For Kinsella, it’s yet another proof point. “It sends the message to the industry,” she says. “When you can prove that something’s working, marketers will spend more money.”

TVSquared helps brands learn how TV advertising is driving traffic to their websites.

One of the company’s two main software pieces is ADvantage, a platform providing offering insight in to how each TV impression drives revenue through online, mobile and second screen for advertisers looking for accurate same-day TV attribution.

The company’s Predict tool helps advertisers automate the creation of their buy specifications based on predictive analysis of historical attribution data that is optimized, whether the objective is to generate sales, registrations, web site visits or any other kind of response.

According to eMarketer, US CTV ad spending was due to total $8.11 billion in 2020, increasing to $11.36 billion in 2021. By 2024 it will reach $18.29 billion, more than double the amount spent this year.

The group expects about half of that to be programmatically traded.

That is still a small fraction of a US TV ad market worth almost $70 billion a year.

‘AVOD will win’

But Kinsella believes the advantages of connected TV will continue to become clear.

“The big thing for marketers right now – and this is where I see the CTV and the AVOD guys winning – is flexibility, transparency, and the ability to optimize,” she says.

“Because they came from a digital world, they’re very comfortable doing that, and they’re very comfortable having those types of conversations

“I think the AVOD platforms are leaning heavily in to measurement and attribution platforms because it’s a differentiator. They can prove that their stuff is working exponentially well over and above linear. They’re going to win.”

You are watching, “The Stream: New Audiences, New Opportunities,” a Beet.TV leadership series presented by Tubi. For more videos, please visit this page.

]]>“The streamers at Tubi, we’ve learned a lot especially in the past year as we’ve seen massive growth on the platform and the entire streaming industry has seen huge influx,” Natalie Bastian, vice president of marketing at Tubi, said in this interview with Beet.TV. “Because of this massive growth, we have access to millions of active users monthly, consuming a lot of content.”

Last year, viewers consumed 2.5 billion hours of content on Tubi, which offers a mix of 30,000 free movies and TV shows. Tubi’s average audience is 20 years younger than that for linear TV, a key differentiator for brands seeking to reach Generation Z as the group’s spending power grows.

“We’ve really uncovered what their behaviors are, what content they like to watch and then ultimately, more detail around their basic demographics,” Bastian said. “At a high level, our audience is young, diverse and dispersed across the U.S., so they’re nationally representative.”

Fox Corp. last year bought Tubi for $440 million in cash as media giants gobbled up streaming platforms or launched new services. To help maintain its momentum and reach new viewers, Tubi in January launched its first national advertising campaign.

Source: eMarketer

“This focus was to drive mass appeal and awareness of the Tubi brand, and the availability of all the free content that’s available to consumers,” Bastian said. “For us, it’s really important for us to focus on free, because unlike other platforms, we don’t use free as a tease. We use it as a vehicle to drive consumption.”

The campaign so far has driven a lift in awareness among all demographic groups, early research indicates.

In addition to its consumer marketing efforts, Tubi also is working to raise awareness among advertisers and media buyers. A key selling point is Tubi’s 64% incremental reach to Fox’s broadcast channel, and its 80% incremental reach among the top 25 cable channels.

“That translates into this audience that’s moving away from traditional TV, but also shows there’s a hunger for free, ad-supported content,” Bastian said.

Tubi also highlights to opportunity for brands to stand out on its platform, rather than get lost amid the clutter of other commercials.

“We pride ourselves on having the lowest ad load in the industry, and we recently launched an advanced frequency management tool to allow brands to better optimize their frequency, which translates into a better overall ad experience for brands,” Bastian said. “Other third-party measurement vendors are able to tap into our audience and blend over with campaigns, and drive additional results for brands as well throughout the entire funnel.”

Tubi recently launched a client advisory board to gain greater insights about advertisers and their expectations for over-the-top (OTT) and AVOD platforms.

“That kind information is helping to fuel our focus, especially going into upfronts and the year ahead,” Bastien said. “As brands continue to look for mass scale and reach, it’s not a one-stop shop for streaming yet — it’s a combined approach. It’s important to differentiate and also show how the Tubi audience is complementary to other players in the space.”

You are watching, “The Stream: New Audiences, New Opportunities,” a Beet.TV leadership series presented by Tubi. For more videos, please visit this page.

]]>Shifting viewing behavior has been compounded by pandemic business economics.

In this video interview with Beet.TV, Mark Rotblat, CRO of Tubi, the ad-supported video platform acquired by Fox last year, says that leaves providers in the category sitting pretty.

Upfront bounce-back

“(Last year), some advertisers lessened their their upfront (TV ad spending) commitments, or they sat out completely – and then others jumped in and made up for it,” Rotblat says.

“The advertisers that tried to then change course and get back in middle of Q4, some of them were left out of what they really wanted in terms of amount of inventory.

“This year, we expect the pressure to be even greater as traditional brands that are in industries like automotive, entertainment and travel come back to full strength.”

What does full strength look like? It looks like traditional TV supplanted by new, ad-supported video-on-demand (AVOD) services. The likes of Tubi, Pluto TV and Xumo, amongst others, are offering viewers a TV-like experience and advertisers the targeting capabilities they have enjoyed in digital.

Murdoch’s expectations

Fox CEO: ‘We Can Win in the AVOD World’ – Media Play News: https://t.co/w43OwBqjgX #Tubi #Fox #AVOD pic.twitter.com/AjNrXCnDFC

— Media Play News (@MediaPlayNews) March 6, 2021

Which is why Fox came sniffing. In summer 2020, the company acquired Tubi for $440 million.

In last month’s earnings call, Fox Corporation CEO Lachlan Murdoch was bullish on the deal:

“We envision Tubi becoming a $1 billion business and a core pillar of Fox.

“Revenue for this past quarter alone broadly approximated Tubi’s revenue for the entire fiscal year before we acquired the company.

“We expect Tubi revenues to more than double in the current fiscal year, to exceed $300 million.”

If that target is also pressure, Rotblat doesn’t seem phased. “Tubi has been essentially P&L-neutral for Fox,” he says, “which is just so different than the businesses of SVoD competitors and those who are really losing billions a year on content as investment.”

Market position

It's an honor and a privilege. https://t.co/KQdUDU3HpV

— Tubi (@Tubi) February 17, 2021

Amid the ongoing boom in subscription video services (SVoD) like Netflix and Disney+, which are cornering the market for premium catalog, we are seeing the rise of free AVoD services, with acquisitions in tow – Xumo to Comcast, Pluto TV to Viacom and Tubi to Fox.

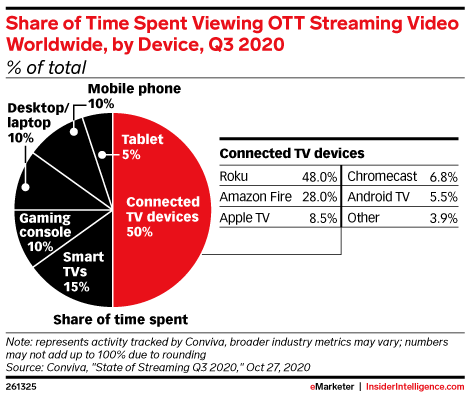

AVoD has become a key trend just as the services found new potential customers currently locked-down at home. More than 80% of Tubi’s viewing takes place on TV sets.

- Tubi is an ad-funded (AVoD) TV service at a time when many advertisers are pulling back on spending.

- But Tubi is also has also seen dramatic growth in stay-at-home viewing numbers during the pandemic.

- Targeting and control offered by digital-style buying may give advertisers the confidence they need in results from their spend.

- Consumers’ premium SVoD subscriptions may be tested in the months ahead – if economic conditions worsen, free TV could look attractive.

Complementarity

The Fox acquisition will help all of that. By November, Tubi was streaming about 200 million hours of content a month, up from about 160 million hours in its pre-pandemic days.

Rotblat says: “What’s different in the programme is we continue to get great Fox content from Fox Entertainment, and there’ll be more and more to announce as part of the upfronts this year,

“Tubi streamers are 20 years younger than the TV linear audiences. So that’s where there’s complementarity to those on linear and particular than on our Fox Entertainment and Fox portfolio of counterparts.

“We have about 80% of our streamers can’t be reached across the top 25 cable TV networks, 64% of Tubi streamers can’t be reached across Fox Entertainment.”

You are watching “The Stream 2021: New Audiences, New Opportunities,” a Beet.TV leadership series presented by Tubi. For more videos, please visit this page.

]]>