“A lot of what’s happened in the last few years is responding to the digital challenge,” Pete Doe, head of research at Xandr, a leading, data-enabled advertising technology platform, said in this interview with Beet.TV. “Attribution is something that commonly comes along with digital measurement. Increasingly, what we’re seeing is that people involved in the buying and selling of TV are used to seeing what happens in digital, and expecting similar measurement and effectiveness.”

Data-driven linear TV has a role in reaching mass audiences even as advertisers shift spending into addressable channels for more focused targeting.

“If we think about television still being a great medium for building reach and improving consumer sentiment, sometimes it doesn’t require addressable,” Doe said. “It requires a well targeted linear campaign. Addressable has its part at different parts of the funnel.”

A key challenge is developing measurement tools that help buyers and sellers of advertising to form a common understanding of the value of addressability.

“There’s still a long way to go to get to a standardized approach for addressable. There’s a lot of progress being made toward that,” Doe said. “For data-driven linear, we’ve made a lot of progress in standardizing how the numbers are counted.”

Xandr participates in the Advanced Targets Standards Group, which was formed in 2016 to bring together buyers and sellers of advanced TV advertising. The group developed guidelines for data use, cross-platform consistency and data-driven linear transactions.

Source: eMarketer

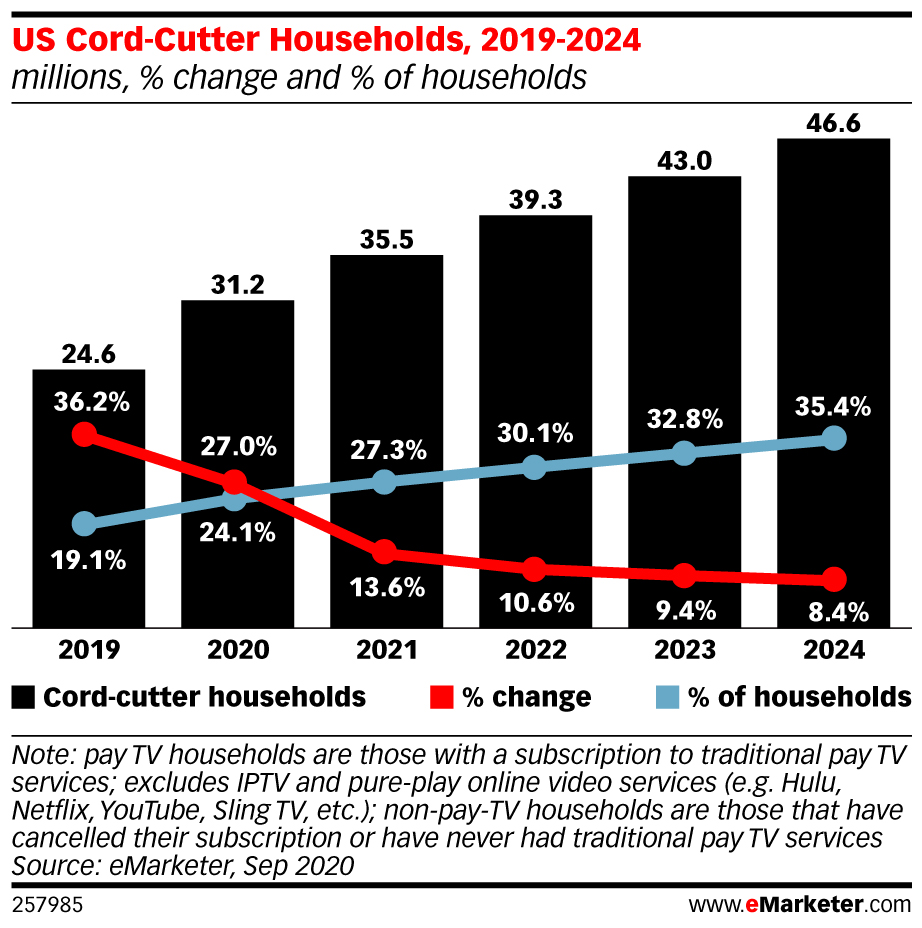

Cord-cutting is forecast to become more common, challenging advertisers to reach households through connected devices that carry a mix of streamed video and live TV. As consumers switch among platforms and devices, measuring their viewership will help advertisers see a more complete picture their prospective customers.

“People have been talking about ‘cross-platform’ for well over a decade, now, and will continue to talk about it. This year we will see some real progress with that,” Doe said. “Buyers and sellers of advertising want to understand the holistic behavior. The ability to holistically combine the OTT and linear inventory is what we’re focused on. We’re making great progress on that.”

You are watching “Where We Go From Here: The Lessons and Opportunities of 2020, ” a Beet.TV leadership series presented by Xandr. For more videos, please visit this page.

]]>Now the new year is set to see it take off even farther.

In this video interview with Beet.TV, Daniel Clayman, Xandr VP and MD for Northern Europe, explains what 2021 means for CTV growth in his region.

Big and ready

Clayman explains that, in Europe, CTV is a little less mature in some ways than in the USA.

“CTV is probably a couple of years ahead in the US just by nature of how TV and distribution of TV works, it’s quite different to Europe,” he says.

“Whilst the number of opportunities is smaller, they’re still very large and we plan to be going off to them pretty significantly next year.”

In Europe, entrenched broadcasters, many of them public broadcasters, have got their CTV game in order, bringing authenticated multi-platform viewing environments to market for consumers, and bringing consumers’ data to market for advertisers.

Identity for TV

It’s not just market maturity that is different across the Atlantic. Strict privacy regulation has also thrown a curve-ball to TV ad targeting, limiting some aspects of advanced viewer profiling.

Even so, many CTV deployments actually lack audience identifiers in the first place.

The ways which CTV practitioners have found around that challenge actually make them more developed than some peers who are pondering the demise of desktop and mobile cookies.

“We’ve found some great partnerships with the likes of InfoSum that will allow us to take a unique stance to the buy and sell side on that front,” Xandr’s Clayman says.

CTV growth

Xandr emerged after AT&T’s acquisition of ad-tech firm AppNexus – the Big Bang for what is now an expanding luxury of opportunity available to Xandr itself.

Xandr launched Invest TV, a platform for TV ad buyers to transact using data across multiple linear programmers, in March 2020 – just as COVID-19 was taking hold, but just in time for a boom in connected TV viewing.

The suite began with Xandr parent WarnerMedia, AMC, and Disney on the system, and recently added A+E Networks and Crown Media Holdings.

AT&T Marketing, Hearts & Science and Media Hub also came on as buyers.

We’re ending our #XandrConnect filled week with the launch of Xandr Connect Magazine, which covers the latest technologies, thinking and collaborations driving media and advertising.

Click the link below for more! https://t.co/tOseg5F1xk pic.twitter.com/VIKu1e6ICH

— Xandr (@xandr) November 20, 2020

Transparent TV

The company’s Clayman says ad buyers and sellers want transparency in connected TV.

“We’ve worked for the last two or three years in terms of signing contracts with our publishers that would allow us to share our SSP or technology take rate with the buyer that we charge to the publisher,” he says.

“That allows us to bring 100% working media to the supply chain. Clients can see exactly where their money goes.

“Most SSPs and DSPs won’t sign those types of contracts. The footprint on the sell side, plus our ability to get these contract signed has given us a very unique proposition that isn’t in market elsewhere.”

You are watching “Where We Go From Here: The Lessons and Opportunities of 2020, ” a Beet.TV leadership series presented by Xandr. For more videos, please visit this page.

]]>That is the challenge this year for Xandr, the advertising and analytics division of WarnerMedia, as it ponders the next phase in its product evolution.

In this video interview with Beet.TV, Eric Hoffert, SVP, Video Technology, Xandr, explains that the imperative is to bring together a world of possibility in a way that is effortless for customers.

Unifying the experience

“As we look to phase three of what we’re doing, we’re looking to stand that up in an extremely powerful way,” Hoffert says.

“The digital video platform for advertising at AppNexus and Xandr and the Invest TV marketplace that we stood up, they have common look and feel, they have single-sign-on access. So we’re bringing these different workflows that are quite different under one umbrella. That’s a key part of our next step, to make this easy for buyers and also powerful for sellers.

“Typically, these have been fragmented processes in terms of selling either your digital video inventory or your data-driven linear inventory. So, I think as we look forward to 2021, we’re really looking to play a key role to bring these disparate worlds together into a unified solution.”

CTV growth

AppNexus’ DSP in 2019 was rebranded as “Xandr Invest”, whilst Xandr has since made a foray into the connected TV space.

Xandr launched Invest TV, a platform for TV ad buyers to transact using data across multiple linear programmers, in March 2020 – just as COVID-19 was taking hold, but just in time for a boom in connected TV viewing.

The suite began with Xandr parent WarnerMedia, AMC, and Disney on the system, and recently added A+E Networks and Crown Media Holdings.

AT&T Marketing, Hearts & Science and Media Hub also came on as buyers.

Unifying buying

Even within that platform alone, Hoffert’s team is having to consider how to make a whole kingdom of different opportunities available to users in a way that doesn’t overwhelm.

“Within Invest TV, we have the capability to support aggregated reach for buyers, which is a really core requirement for TV buying,” he says. “And we can meet the market where it is today, which is through the use of Nielsen, age, and gender, and advanced audience.

“But we’re really showing people the possibilities for where the market can go by using Xandr first-party data, audience segments, and measurement.

“And so we’re offering really both methodologies into the buying community for how you can buy and sell premium television inventory through a digital platform.”

You are watching “Where We Go From Here: The Lessons and Opportunities of 2020, ” a Beet.TV leadership series presented by Xandr. For more videos, please visit this page.

]]>“When we think about the transformation of television, it really started with data-driven TV, and ways of bringing data models and data-driven buying and selling and planning to television,” Christina Beaumier, senior vice president of product and technology at Xandr, the advertising and analytics unit of WarnerMedia Commercial. “Some of these models have been deployed in digital for many years, but digital and television have been delivered differently.”

Expanded Consumer Choices

Advanced TV, which includes data-driven linear and addressable TV, is still seeing growth even as advertisers spend less on linear TV overall. Advertisers are following audiences to streaming video platforms that are free for viewers to watch, including Peacock, Pluto TV, the Roku Channel, Tubi and Xumo. The services are especially popular with younger cord-cutter and “cord-never” consumers.

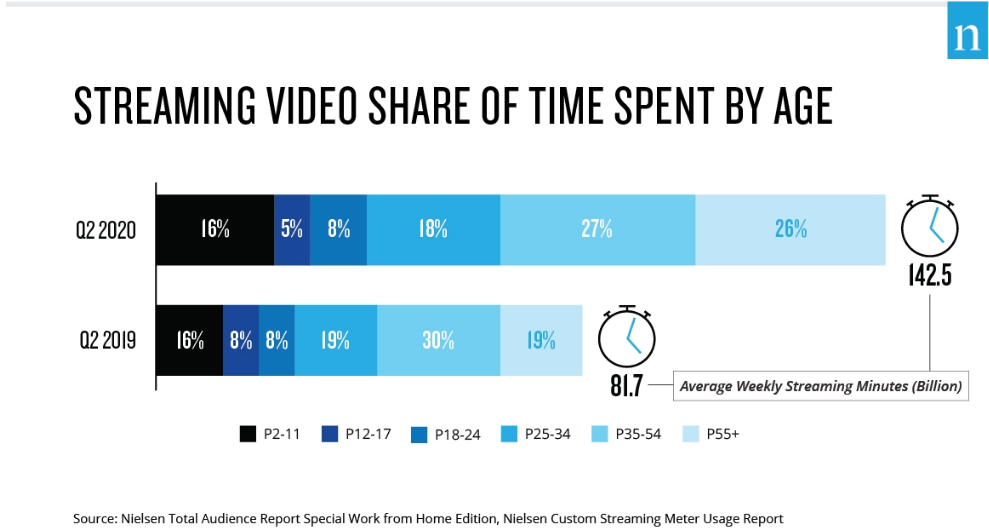

Source: Nielsen

“Now, we’re focused on following the customer to these new streaming types of delivery models,” Beaumier said. “We need to think about how we can bring together the advanced buying platforms like data-driven linear and addressable to streaming so that it can be thought of as one.”

The transition to a more unified media marketplace is a broad undertaking involving media owners, marketers and advertising technology companies. It requires a common approach to data, identity and measurement.

For sellers of media, the priority is reaching audiences among different viewing devices, including smartphones, tablets and connected TVs.

“Making sure that their audiences are delighted with their content, and have the ability to view that content in whatever format” is the key goal for sellers, Beaumier said. “Distribution shouldn’t matter — it really shouldn’t. The challenge for sellers is making this a reality, making it so that distribution channel isn’t driving everything.”

You are watching “Where We Go From Here: The Lessons and Opportunities of 2020, ” a Beet.TV leadership series presented by Xandr. For more videos, please visit this page.

]]>But few ad agencies out there believe that a grand lurch from one medium to another would be sensible.

In this video interview with Beet.TV, Dentsu Aegis Network’s VP of video innovation Brad Stockton says a multi-channel approach is vital.

Going omni

“We don’t look at any one tactic alone,” Stockton says. “Whether it’s linear TV, if it’s connected TV, digital video, or social, it’s really about starting with ‘where are your people consuming content?’

From there, we’re going to identify the best ways to measure how those audiences are watching that content and the effectiveness of reaching them on said platform.

“So, it’s really about an omnichannel strategy and not looking at any one platform in a silo.”

Best of both

Despite the seemingly binary nature of digital and TV, the application of data is also revolutionizing the planning and buying of linear television.

“The truth is, every client can make sense for advanced linear,” Stockton says.

“We know ratings fragmentation is continuing to happen, but we know that TV works. So, that doesn’t mean that we should just stop buying TV, or only move to an addressable audience or a people base.

“(We can) go after audiences that are actually category buyers, as opposed to 18 to 49, or 25 to 54. It’s really about taking your linear audiences and really understanding what day parts programmes and networks are going to work the hardest for you against your core audiences.”

Stockton is talking about brands like quick-service restaurants that have wide appeal across demographics, for which advanced targeting can reveal lucrative audiences, nevertheless delivered through channels like TV.

sdfAudience-first

Stockton says modern agency business invokes software from platforms like Xandr to identify the networks, day parts and time periods that makes sense for brands to reach particular audiences, buying the correct schedule.

He says effective strategy is not just about taking a channel-by-channel approach . Rather, it is increasingly possible to find and reach the right audience, on whichever platform they happen to be.

“The truth of the matter is, consumers dictate how our strategy should be moving forward, where consumers are watching content,” he says.

“How they’re watching content is ultimately how we have to make sure, as advertisers, we are being as agile as possible to following the eyeballs.

“Ultimately, we have to find our audiences and, if advanced TV gives us the ability to do that, we’re just ensuring that we’re always pushing the boundaries to ensure that we are still always testing and learning.”

You are watching Where We Go From Here: The Lessons and Opportunities of 2020, a Beet.TV series presented by Xandr. For more videos, please visit this page.

]]>“In recent years, there have been certain concepts that have come to TV in terms of data, automation and the ways in which content is distributed,” Jason Burke, vice president of strategy at Xandr, said in this interview with Beet.TV.

He joined Xandr with its 2019 acquisition of Clypd, which focused on data-driven advertising solutions for television. Xandr is the advertising and analytics division of WarnerMedia Commercial, a unit of AT&T’s WarnerMedia.

Evolution, Not Revolution

Digital technology is transforming the marketplace for linear TV with more applications for data and automation to drive scale.

“The challenge with that is that TV lacks some of the industry standards that are ubiquitous in the digital world. A lot of those things have started to come together in the past few years,” Burke said. “This not a revolution, it’s an evolution. We’re just now seeing the hockey stick starting to appear.”

The data-drive transformation is helping sellers maximize the value of their advertising inventory, while helping media buyers to reduce wasteful spending with improved targeting.

“Even though the plumbing, and the business models and pricing are different — for clients and agencies, it’s really about driving outcomes,” Burke said. “As you start to pull all of these pieces together — media owners, media buyers, advertising technology and data — these are the four legs of the table as it relates to advanced television.”

Data and measurement are even more important as viewers consume content among a wider variety of devices and media channels, including the growing number of video-on-demand services that carry advertising.

“Convergence is a real, real thing right now,” Burke said, adding that the shift is breaking down silos among linear and digital TV to drive value for advertisers. “Holistic value delivered back to the agency or client is critical.”

You are watching “Where We Go From Here: The Lessons and Opportunities of 2020, ” a Beet.TV leadership series presented by Xandr. For more videos, please visit this page.

]]>Case in point – the pandemic has tilted business even farther toward online channels.

In this video interview with Beet.TV, Sunil Naryani, Vice President, Commercials & Partnerships Asia Pacific at Dentsu International, which changed its name from Dentsu Aegis Network in October, says there have been two big changes.

1. Ecommerce has redrawn demographics

“Things have probably changed for a permanent basis and then probably for good because a lot of the Gen X, the baby boomers, have really come online during COVID,” Naryani says.

“You would see them probably making their first (online) grocery purchase in the last three months.”

Older consumers were widely seen as less willing than younger counterparts to embrace technology. But the demands of the pandemic have pushed many of them to use digital services, just as they did younger people.

Naryani says that means the online consumer base now looks a lot more like “the real world”.

2. TV and games booming

Naryani also says the growth in connected TV (CTV) and over-the-top (OTT) viewing options that has occurred in the West has also been seen in his Asia-Pacific region.

In south-east Asia, for example, total streaming minutes grew 57% to reach 107 billion in Q2 versus 68 billion in Q1, according to Media Partners Asia (MPA). That doesn’t include YouTube, which accounted for 84% of Q2 usage, thanks to its carriage of free-to-air TV content.

Often little talked about, video games are surging even more than before.

“There’s a big boom around gaming and APAC kind of leads that across the globe,” Naryani says.

“Almost two thirds of the gaming base as well as the time consumed is coming from APAC.”

Changed world

Taken together, these trends have significantly changed the market that brands want to reach, and how they should do so.

Because the consumers have really changed in the way they’re consuming media and where they kind of be present every day, marketers have to pivot to digital as well,” Naryani adds.

“There needs to be a true embracing of digital, which means that they need to have a proper data strategy, need to know what kind of mar-tech and ad-tech stacks that are using, which can not be just solving for the next three months or four months, but kind of a longer period.”

Naryani also says marketers need to be further educated about how they should use their own, “first-party” to reach consumers.

You are watching “Where We Go From Here: The Lessons and Opportunities of 2020, ” a Beet.TV leadership series presented by Xandr. For more videos, please visit this page.

]]>“Buyers are looking for reach and frequency measurement across all screens, touchpoints and buying formats,” Mike Fisher, vice president of advanced TV and audio at Essence, a unit of WPP’s media agency GroupM, said in this interview with Beet.TV. “As our industry gets closer to a point of unification, bringing together both programmatic traditional buying, linear TV buying, addressable buying into a workflow where the data’s able to feed and inform itself from a higher-level view is super important.”

The supply chain for advertising has become more complex with the rise of online exchanges that let buyers bid for ad placements, while relying on data providers to help improve their targeting.

“Buyers need to understand who’s involved in the transaction, what tools are being used in the decisioning, how the workflow is working,” Fisher said. “When there’s multiple vendors, multiple data partners, multiple buying paths involved in a transaction, it’s important for us as an agency and for our clients to really understand what value is being created by each of those initiatives.”

Meanwhile, content providers need to develop solutions that help media buyers to optimize their campaigns.

“The responsibility of sellers is to start to take their inventory, and add value to it beyond just standard buying, either in a digital landscape/impression-based, or in a linear environment reach-and-frequency-based,” Fisher said.

Providing a more unified view of the linear TV and digital video landscape will take a few more years, with ad ratings company Nielsen announcing last year that it had begun developing those metrics.

“Nielsen had a really good roadmap that they outlined, but that’s three to four years away,” Fisher said. In the interim, buyers and sellers of video need “to figure out ways to better leverage technology to figure out consistent measurement,” he said.

You are watching “Where We Go From Here: The Lessons and Opportunities of 2020,” a Beet.TV leadership series presented by Xandr. For more videos, please visit this page.

]]>For some time, CTV was a powerful but challenging opportunity – the promise to target individual households, if only a host of interconnectivity issues could be overcome.

But, in this video interview with Beet.TV, Eric Hoffert, SVP, Video Technology, Xandr, says this is the year ahead is when Xandr aims to pull together the various investments it has made in the last four years.

CTV journey

“We started our connected TV marketplace in 2017 when the market was really just starting to take off,” Hoffert says.

“Since that time, we have focused on a number of areas to get to market with a very strong, connected TV offering for buyers.”

Xandr’s two key platforms are:

- Monetize: a selling platform that media companies use to unlock inventory value, incorporating yield analytics, ad serving and Xandr’s acquisition of Clypd to enable data-driven linear ad buys.

- Invest: a buying platform which can support use of first-party data to enable data-driven ad buys, incorporating its Invest TV variant and InvestDSP software.

Why must the advanced TV advertising ecosystem evolve in 2021? Xandr's Lindsay Van Kirk shares her thoughts and predictions. pic.twitter.com/aSwumBHNrJ

— Xandr (@xandr) December 31, 2020

‘Treasure trove’

“Over the last three years or so, we have assembled an extraordinary number of high-quality programmers and broadcasters on the sell side,” Hoffert says.

“Whether it’s a vMVPD for streaming TV services or a premier broadcaster or programmer, or a pure-play OTT service – (in) all three categories we have strong inventory access available.”

Xandr emerged after AT&T’s acquisition of ad-tech firm AppNexus – the Big Bang for what is now an expanding luxury of opportunity available to Xandr itself.

“We had the opportunity to be able to tap into a treasure trove of first party data from AT&T, and we’ve been able to integrate that into our CTV offering with a very powerful cross device capability, including a very rich and powerful device graph behind that,” Hoffert adds.

Curated TV

In a year when connected TV growth was accelerated further by stay-at-home orders, Hoffert reports “incredible” growth in cross-device ad viewing.

And, he says, in a landscape where navigating the new supply sources can be difficult for advertisers used to traditional TV, ad buyers want to benefit from curated offerings.

They would group connected TV inventory by characteristics like genre or vertical, rather than leaving buying open to manual precision-targeting alone, although the techniques can be combined.

You are watching “Where We Go From Here: The Lessons and Opportunities of 2020, ” a Beet.TV leadership series presented by Xandr. For more videos, please visit this page.

]]>Together, it makes for a heady cocktail – change, even enforced change, can lead the industry to make overdue changes, to a brighter tomorrow.

In this video interview with Beet.TV, Vin Paolozzi, Chief Investment Officer with Interpublic Group’s Kinesso unit, talks about how these factors are combining – and how ad agencies can help brands navigate the change.

Tech evolution

“We’ve only scratched the surface on how automation will continue to help evolve our thinking around TV buying as well as bringing additional benefits to our advertising clients and partners,” Paolozzi says.

So, what trends is Paolozzi talking about? He says advertising technology is evolving to support:

- Understand where a client’s most sought-after audiences are.

- Translating those audiences back into a publisher’s environment.

- Better understanding of audiences in publisher ecosystems.

“The technology allows us to first understand who those audiences are that are important to clients,” he says.

In this special anniversary episode of #AllJargonAside host Graham Wilkinson and guest Bill Lyman review what they’ve learned in 2020, 2021 predictions, and most importantly – you’ll finally hear Graham’s (very unexpected) “crazy but true fact(s)”! https://t.co/d7IbtSy3ku pic.twitter.com/cKIzqTdpvT

— Kinesso (@kinesso) December 18, 2020

In the family

Kinesso is the division IPG launched in October to provide data-driven capabilities to clients, thinks the unit has plenty of work to do.

Kinesso is comprised of IPG’s addressable activation team Cadreon and its Data and Technology group.

Kinesso works with IPG Mediabrands, Acxiom and will provide services to agencies across the IPG network.

It expected to have a staff of 1,400 in more than 70 countries this year.

Future-facing

“I believe there’s a long way to go in still developing the technologies,” Paolozzi says. “But I think the bright side of this is that, for a long time, we’ve been talking about how technology will continue to evolve the way that we do marketing across the entire ecosystem.

“I think now, more than ever, clients are leaned in and wanting to learn more and more about how that automation helps them drive their business.

“More importantly, (it) helps them understand how best to have and engage and build a relationship with consumers in ways that are ethical, responsible, and important for the future of their brand message as well.”

You are watching Where We Go From Here: The Lessons and Opportunities of 2020, a Beet.TV series presented by Xandr. For more videos, please visit this page.

]]>But that doesn’t mean it isn’t still a relationships business.

In this video interview with Beet.TV, Roseann Montenes, VP, Precision & Performance Ad Sales, A+E Networks, explains why she is focusing on people.

Connecting people

In November, Montenes’ A+E joined Crown Media Family Networks, representing Hallmark, in selecting Xandr’s Invest TV suite to help sell national linear inventory.

She says it helps facilitate relationships between buy and sell side.

“The way that Invest TV has it set up is that we have direct communication with the actual client or the agency, or whoever’s activating the buy, which is most important to us because we are maintaining that relationship,” Montenes explains.

“While a client is submitting the buy and activating through it on the actual Invest TV platform, I’m the one that’s having the conversation, my team is the one that’s having the conversation direct with the one that’s activating that campaign from start to finish

“So it does make it very easy for us to be able to maintain relationships. And like I said, keep that dialogue going because without dialogue comes a failed campaign.”

TV Automation Is Critical: Xandr’s Mitchell Takes ‘Invest TV’ Up To 90% Coverage

Guaranteed outcomes

A+E Networks was relatively early to announce it would offer its advertisers guaranteed business outcomes.

And, now more than ever, Montenes says it is important to help marketers “move some of those products off of shelves for our clients”.

“We’re listening to our clients in what they need for their KPIs, whether foot traffic into store locations, website visitation, and most recently talking about attention measurement and doing a guarantee against attention,” she says.

A+E’s Roseann Montenes: With Client Expectations, There’s No ‘One-Size-Fits-All’

New prospects

Montenes says A+E Networks is using platforms to new business.

“We already do a ton of business with (Xandr-owned) Clypd on a day-to-day basis in terms of utilising them as our day-to-day optimizer,” she says. “So to partner with Invest TV was just our natural progression in terms of our partnership.

“So us, having that kind of exposure on their platform allows us to open doors to new partnerships, new relationships, and really have access to clients that maybe we weren’t having that conversation with originally that now we are having that conversation.”

You are watching Where We Go From Here: The Lessons and Opportunities of 2020, a Beet.TV series presented by Xandr. For more videos, please visit this page.

]]>“The biggest challenge is complexity,” Derek Newman, product lead of advanced TV at Centro, said in this interview with Beet.TV. “In a truly omnichannel media mix, an advertiser will want to have full control and insight into all of those channels and tactics they’re using.”

Centro’s flagship platform, which is called Basis, automates digital operations across programmatic, direct buying, connected TV, search and social advertising. Advertisers use Basis for planning, buying, bill payment, reconciliation, analytics and business insights through a single interface.

“We have digitally native customers looking for ways to incorporate video and TV in their media mix,” Newman said. “Simultaneously, we have marketers in traditional channels, but actually want to reach audiences that are digitally native. You have a market where buyers are coming in, and new solutions are being created. It all adds up to a complex and disjointed industry where these market layers would welcome any form of automation in any part of the process.”

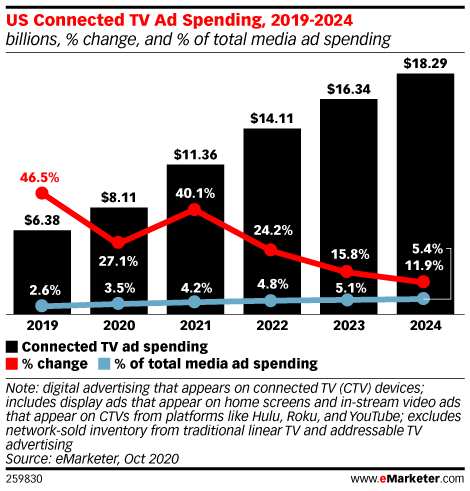

As advertisers seek to reach households that have hooked up their TVs directly to the internet, connected TV ad spending next year will jump 40% to $11.4 billion in the United States, and make up 4.2% of total media spending, researcher eMarketer estimated.

Source: eMarketer

To help advertisers scale up their campaigns, Centro collaborates with companies including Xandr, the advertising and analytics unit of WarnerMedia Commercial, itself a division of AT&T’s WarnerMedia.

“Xandr has been an instrumental partner for Centro to help our advertising clients complement their digital campaigns with the reach of audiences viewing those traditional media channels,” Newman said. “Unfortunately, much of traditional media is still transacted network-to-network. Our partnership with Xandr and our platform provide automation work flows that synchronize well with Xandr’s solution, and help bridge that gap between media buyers and video suppliers.”

You are watching “Where We Go From Here: The Lessons and Opportunities of 2020, ” a Beet.TV leadership series presented by Xandr. For more videos, please visit this page.

]]>Xandr, where Bruckbauer is senior product manager, launched Invest TV, a platform for TV ad buyers to transact using data across multiple linear programmers, in March, just as COVID-19 was taking hold.

The suite began with Xandr parent WarnerMedia, AMC, and Disney on the system, and recently added A+E Networks and Crown Media Holdings.

In this video interview with Beet.TV, Bruckbauer says linear TV targeting capabilities have taken a great leap – but now the industry’s next step must make it easier to use them across publishers.

A fragmented future?

“Audiences have fragmented and made it harder to reach them all,” he says. “It used to be that you could go to a couple of broadcasts networks, do an upfront deal, and reach the majority of your audience.

“Now, with cable networks and streaming platforms and almost the never ending supply of video, it’s harder to reach your audience and get that scale.

“So, I think that the demand from the buy side is to aggregate that, put it back together, allow them to see the whole picture of the audience that they’re looking to target.”

Finding harmony

Bruckbauer is voicing a common concern when it comes to connected TV, even the linear variant.

The proliferation of new viewing packages and platforms has made a plethora of advertising opportunities available. But, unlike TV before them, each is distinct, often disparate technology.

The industry’s next challenge, then, is to make systems that simplify and harmonize what has become a super-capable but fragmented ecosystem.

“The industry needs to allow the buyer to focus on the audience, focus on their performance, and manage reach and frequency across all of those,” as Bruckbauer puts it.

In his most recent piece w/ @Digiday, Mike Welch, Head of Xandr, goes through the ups & downs of 2020, including rapid changes in consumer behavior, the growth of premium video in our marketplace and why Xandr is doubling down on collaboration in 2021.https://t.co/IYqoJ65iiA

— Xandr (@xandr) December 14, 2020

Targeted evolution

Even so, it is testament to how far the idea of advanced TV advertising has come that the key challenge is managing so many inventory options. A historic complaint was that there is insufficient inventory in the first place.

Nowadays, many more ad buyers are using digital platforms to target on-demand and linear TV.

“We offer Xandr database targets that are comprised of our gender data traits and segments, as well as Nielsen traits such as MRI, MBI segments,” Bruckbauer says.

“The big value that we’ve worked to enable this year is to allow first-party data matches against both of those. So, if you’re an advertiser … and you have a first-party data set, we can match that against that Xandr data subscriber base or against the Nielsen panel, and then look at the viewership of that first-party that you’ve defined in order to create an optimal proposal for it.”

Tackling that across each publisher or broadcast platform is a challenged, but Bruckbauer thinks the industry can get there.

“The industry is evolved by combining all of those different supply types and bringing it all together for the buyers,” he says.

You are watching Where We Go From Here: The Lessons and Opportunities of 2020, a Beet.TV series presented by Xandr. For more videos, please visit this page.

]]>“There’s a lot of value for clients in being able to plan and then measure holistically … so that we can deliver a de-duplicated view that is going to help advertisers spend their budgets more efficiently,” said Lauren Bernard Mannix, vice president of market solutions at Kinesso, the marketing technology platform started by Interpublic Group.

In this interview with Beet.TV, Bernard Mannix described how Kinesso has collaborated with database marketing company Acxiom to create high-value audiences for targeted advertising on linear TV and digital video channels.

The companies have been “working on direct integrations with a variety of different owners of subscriber data or device owners … so that we can create one-to-one matches between those entities and the Acxiom universe,” she said. “Through those connections, we’re able to develop a lot of interesting use cases.”

Those applications include one-to-one segment syndication and ingesting exposure files for holistic measurement after a campaign has run. Kinesso supports data-driven buying strategies for linear TV with a platform that provides its buyers with automated workflows for allocating budgets among networks and measuring the results.

“Through our data-driven linear application … we can inform our proposal requests to networks based on our de-duplicated view and forecasts of audience reach across different networks,” she said.

You are watching “Where We Go From Here: The Lessons and Opportunities of 2020,” a Beet.TV series presented by Xandr. For more videos, please visit this page.

]]>“Agencies and marketers are cost-conscious,” Sarah Warner Harms, vice president and agency platform lead at Xandr, said in this interview with Beet.TV. “They’re thinking about transparency and suppression of fees, and making sure they have direct and efficient access to supply.”

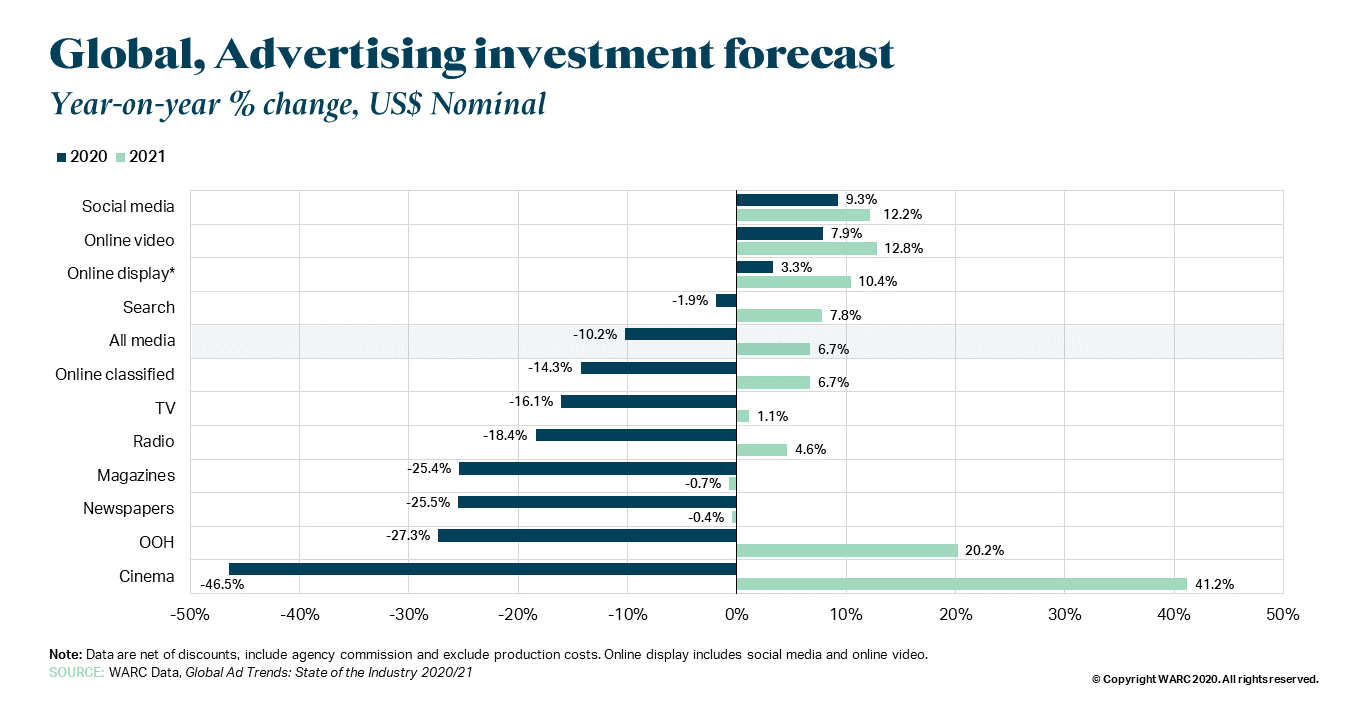

Global media spending will fall by 10% to $557.3 billion this year as the economic fallout of the pandemic weighs on marketing budgets, researcher WARC predicted. Contrasting with that decline, spending online video will grow by 7.9% this year and by almost 13% in 2021 as advertisers seek to reach younger consumers who are spending more time online.

Source: WARC

Contextual Ad Placements

As consumers shift their viewing to digital platforms, advertisers are looking for improvements in audience identification that helps to improve the efficiency of their media buys while also protecting consumer privacy. Advertisers also are basing their buying decisions on surrounding programming that’s most likely to appeal to their target consumers.

“You’re seeing an increase in contextual buying,” Warner Harms said, adding that there’s a need “for a scaled source of truth for identity, and making sure you can holistically manage that across your relationships and across different buying platforms.”

Part of her job at Xandr, which is AT&T’s digital advertising exchange, is dispelling misconceptions that programmatic media buys consist of deeply discounted fragment inventory that’s difficult to measure.

“The better business practices surrounding transparency and access to data really should give buyers peace of mind that platforms are really a place to activate and streamline their buying,” she said. “Another thing I like to talk about is a ‘second flavor of supply path optimization.’ Instead of access to supply, it’s access to content and making sure each buyer understands how and where they are getting access to certain television content.”

Programmatic TV ad spending will more than double to $6.69 billion in the U.S. by next year, EMarketer estimated last month. The researcher also forecast that CTV ad spending would reach $10.8 billion in the U.S. next year, and make up about 15% of total TV ad spending.

“Identity and connected television has been a challenge for the industry that we’re all collectively trying to solve,” Warner Harms said. “Making sure buyers understand and have relationships with the scale of platforms or media owners that have a true deterministic audience set — that’s where we see a lot of the focus and investment going.”

You are watching Where We Go From Here: The Lessons and Opportunities of 2020, a Beet.TV series presented by Xandr. For more videos, please visit this page.

]]>In this video interview with Beet.TV, Tyler Fitch, VP, Advertising Partnerships at Tubi, says that Tubi is building on its heritage in automated TV ad sales.

Rather, now that it is owned by Fox and going after bigger budgets, it is getting consultative with ad buyers.

Programmatic and beyond

“Historically, Tubi has been a programmatic-first publisher,” Fitch says. “As we were growing up, we had a very small sales team.

“But as we’ve grown as a company, we’ve flipped the script on that. This year was the first upfront we did with our now parent company, Fox.

“And so we’re switching from the almost totally-programmatic model, to the upfront model and scatter model, as well as being able to tap into programmatic.”

That includes allowing ad buyers to use whichever DSP they like, including Xandr.

Big Day for the @tubi team! Fox Corp. has struck a deal to acquire the streaming service Tubi in a deal worth as much as $490 million. https://t.co/KZdBTv9KyI via @WSJ

— Tyler Fitch (@tylerwfitch) March 17, 2020

Menu for measurement

As it does so, Tubi is finding that it needs to service ad buyers with a range of goals and a range of measurement ambitions.

“Do they want to measure foot traffic, reach and frequency, on top of what their linear buys?” he says. “Anything from sales lift, brand lift, all these things that we’re able to measure now with CTV on TVs, that historically linear hasn’t been able to do.

“It’s going to be different for each person. Do they want to measure sales lift within a store, like SKU-level data? Do they want to just buy extra eyeballs from their linear buys? Do they want to make sure that people are seeing they’re adding, going to their store, or using their delivery service or buying something?

“So there’s really a solution for everybody when it comes to proving ROI and spend.”

AVOD outlook

EMarketer expects 7.5% of US pay-TV households to “cut the cord” from traditional cable or satellite packages in 2020.

Although subscription has taken off, ad-supported services are also growing. EMarketer estimates CTV ad spending will reach $10.81 billion in the US in 2021.

That set light to the AVOD opportunity, with Comcast buying Xumo, Fox buying Tubi and Viacom acquiring Pluto TV. Some in the industry believe consumers will hit a ceiling in the number of subscription services they can sustain but that appetite for content will grow nevertheless, leaving a free, ad-funded option looking like an easy addition.

- These are ad-funded services at a time when many advertisers are pulling back on spending.

- But they have also seen dramatic growth in stay-at-home viewing numbers during the pandemic.

- Consumers’ premium SVoD subscriptions may be tested in the months ahead, if economic conditions worsen, leaving free TV looking attractive.

TV’s strong suit

A common view in the connected TV space, as it matures, is that, whilst CTV supports advanced targeting and other digital tricks, buyers need to wrap their heads around it.

“We always know that TV is the most powerful medium that you can have in order to reach people from a marketer’s perspective, and it’s enabled storytelling,” Tubi’s Fitch adds.

“It is still TV, but it’s just but digitally. So we’re proving out this other medium is just as strong as what they’re comfortable with, when they talk about linear buying across what they’ve been doing the past 50, 60 years.”

You are watching Where We Go From Here: The Lessons and Opportunities of 2020, a Beet.TV series presented by Xandr. For more videos, please visit this page.

]]>Invest TV employs a user interface to enable automated buying and unified reach.

Earlier this year, AMC Networks, Disney and WarnerMedia became the first programmers offering national linear inventory through the platform.

And now A+Networks and Crown Media Family Networks, representing Hallmark, are following suit.

Here is today’s announcement.

90% coverage

In this video interview with Beet.TV, Xandr VP Mark Mitchell explains what is going on – and what ad buyers are asking for these days.

“They can log on, they can define a strategic audience in the platform and they can transact directly with 52 national cable networks that reach over 90% of all TV households in the country,” Mitchell says.

“It opens up a really streamlined and very flexible way for national buying on linear to use strategic audiences for the first time.”

The announcement came amid Xandr Connect 2020, Xandr’s annual event including a series of discussion events to watch.

It’s all about connecting! Today, we’re kicking off a week full of conversations around the TV and digital advertising landscape with thought leaders around the globe! #XandrConnect

Connect with us by registering here: https://t.co/XUD8xc0XoL pic.twitter.com/7HqLzSbbFN

— Xandr (@xandr) November 16, 2020

Inflection point

Invest is Xandr’s platform powering ads across digital video, connected TV and data-driven linear supply using first-party data and self-serve UIs.

Invest TV was launched six months ago.

For A+E, using Invest TV means an expansion of its Precision & Performance offerings. Crown Media Family Networks says there is an “inflection point” in the use of data-driven insights for TV campaigns.

“It’s critical for buyers and sellers whose legacy systems don’t really work beyond traditional age and gender to have more automation and more technology in place to manage the data that’s necessary to do that,” Xandr’s Mitchell adds.

AT&T's Xandr says AMC Networks, WarnerMedia, and Disney joined Xandr Invest, its self-serve ad-buying platform, which will be available for 2020 "upfronts" (@bristei / Variety)https://t.co/PDGNCWoYPMhttps://t.co/6mAcMbPF1D

— Mediagazer (@mediagazer) March 11, 2020

You are watching Where We Go From Here: The Lessons and Opportunities of 2020, a Beet.TV series presented by Xandr. For more videos, please visit this page.

]]>But GroupM is still kicking the tyres of a burgeoning range of suppliers.

In this video interview with Beet.TV, Matt Sweeney, chief investment officer for GroupM US, describes spending trends and his wishlist for platforms.

Growing spend

“We’re increasingly spending and investing more and more dollars against advance TV, and this year’s upfront,” Sweeney says.

“We probably grew another 25% on top of 25% the year before. So they’re meaningful numbers there now.”

GroupM operates Finecast, its own unit dedicated to buying ads in connected TV, which has become a major source of big-brands CTV ads.

But Sweeney says the agency is having to navigate through an array of new options.

Partnership criteria

He says he is trying out supply-side ad platforms (SSPs) – software through which publishers make ads available to buyers – like that from Xandr, for these criteria:

- “Unique and advantages data – there really are only a few that have unique and advantaged data in the marketplace.”

- “Access to that data.”

- “Supply that’s fraud-free and brand-safe and available at scale.”

- “A technology partner that allows us to eventually leverage that on the platforms, with our own traders, and bringing our own data science and our machine learning to help find audiences at scale for our clients.”

Test and learn

Sweeney says GroupM is having to pick through a proliferating array of options.

“There has been a proliferation of new streaming services,” he says. “There are just so many different options right now.

“What we’re deciding to do is to test all, or as many as make sense for our clients, and then sort of double down and invest with the folks who are delivering the best either extension or the best experience for consumers.

“We’re looking at a combination of those factors, as we figure out who the proprietary or preferred partners are in this space.”

Drop ad prices for test

And, though connected TV ads command a premium for their ability to target viewers and support tactics like frequency capping and attribution, he is urging publishers to drop their prices.

“I’ve encouraged the partners in this space to put some skin in the game and not look for some of the high premiums that they’ve traditionally been charging as a way to sort of incent and compel clients to test it out,” Sweeney says.

“Even with some of the challenges around ratings degradation and prices, the inflation that’s been paid, (TV is)s still a pretty efficient medium to trade.

“If you want to break into that and have some of those dollars migrate over to either a new platform or a new data set, you’re going to have to cede the water a bit and incent some of those tests.”

You are watching Where We Go From Here: The Lessons and Opportunities of 2020, a Beet.TV series presented by Xandr. For more videos, please visit this page.

]]>That is according to one executive in the box seat for the connected TV revolution.

“We are now seeing supply that’s available to be monetized in CTV, exceeding or growing faster than the demand is growing,” says Lauren Wiseman, who oversees OTT and programmer partnerships at Xandr, AT&T’s advanced advertising unit.

In this video interview, Wiseman puts that change down to three main trends:

1. COVID-19 content

“Right now, a lot of us are at home consuming tonnes of content – much of that is ad-supported,” she says.

EMarketer now estimates CTV ad spending will reach $10.81 billion in the US in 2021.

That is up 56% from two years earlier, and represents around 15% of total US TV ad spending.

The COVID-19 pandemic has prompted increased connected TV viewing, including increased demand for subscription VOD. But there is a view in the industry that SVOD growth will eventually saturate, leaving ad-supported CTV services in a favorable spot.

2. Header bidding

Increased efficiencies from “header bidding” technology is encouraging some broadcaster and distributors to expand the partners from whom they accept ad demand, Wiseman says.

Header bidding is the technology that allows publishers to entertain ad bids from multiple auction services simultaneously, rather than in sequence, thereby encouraging best and highest bids. Wiseman says header bidding, which started in digital display advertising, has now evolved to suit connected TV.

“What we’re seeing now in CTV (is that) header bidding, particularly Prebid, is a very widely adopted technology in the display world,” Wiseman says. “But there’s a lot of nuance and complexity in CTV.

“What we’re seeing with Prebid is that we’ve rebuilt that technology to consider ad podding and competitive separation, really the needs of the publisher to degenerate revenue, the needs of the user to have a decent viewer experience and not see the same ad over and over again, and the needs of the buyer to make sure that frequency capping and their rules are enforced.”

3. Top of the funnel

Wiseman also thinks connected TV, despite all the promise about precision targeting at the household level and digital-style control, is starting to be used a lot like traditional TV ads.

“The third trend that we’re seeing with the growth of CTV is, CTV moving up-funnel,” she says.

“What are the use cases that CTV is solving for? What are the use cases that programmatic is solving for? In some cases, programmatic is backfill and that’s a great use case for it when impressions aren’t sold through a direct sales team.”

Supply and demand

All of that makes the role of supply-side platforms (SSPs) important.

Wiseman says she has learned something important from offering Xandr Monetize, the company’s own ssp.

“An SSP’s role is often to provide incremental demand to what a direct sales team is responsible for or enable a direct sales team to sell programmatically,” she says.

“So that’s where we’re leveraging Xandr audience segments based on AT&T data to help drive new and differentiated demand into the marketplace in addition to powering a broader marketplace as a technology platform.

You are watching Where We Go From Here: The Lessons and Opportunities of 2020, a Beet.TV series presented by Xandr. For more videos, please visit this page.

]]>If you thought the US CTV environment was fragmented, the European marketplace – marked by a host of nation states as well as a plethora of viewing options and trading methods – is even more so.

In this video interview with Beet.TV, Vincent Soucaret, the head of EMEA video advisory for AT&T’s Xandr ad unit, describes the picture for an ad format he says has been seeing “triple-digit growth” in spending.

Supply is constrained

“We basically have less supply,” Soucaret says. “It’s very, very fragmented. The supply in local markets is very short as compared to what you can see in the US.”

Diverse delivery methods

CTV ad inventory supply is constrained for a variety for reasons – not least the proliferation of devices and services which have caused CTV viewing itself to rocket in the first place. In Europe, that is even more so. In France, for example. over-the-top TV apps are less popular than elsewhere, because ISPs got an early foothold by offering their own “IPTV” services to their own-brand TV-over-broadband boxes.

Elder age profile

“The adoption of the technology by its population might be slowed down by a little older population in some countries than others,” Soucaret says. “Where, in the US, I think the median age (of a CTV viewer) is 37 years old or something in some countries in Europe, it’s a little bit older.”

More cooperative

In Europe, broadcasters aren’t just partnering to make ad sales easier across the industry – some are also coming together in shared content platforms. For example, BritBox has been launched as a joint SVOD by the BBC and ITV, traditionally two public service TV rivals in the UK. Soucaret sees more such services gathering pace, as the sell side aims to compete with Netflix’s ad-free experience.

Education

“A lot of the buyers are not trained enough in what is CTV,” Soucaret says. “They’re used to that digital mindset to target individual users. (But) that might not always be the case when we talk about CTV because we usually target at the household level.”

The forward march

Despite the challenges, Soucaret says broadcast TV ad sales houses are wanting to switch on to programmatically-enable their CTV ad sales.

They are now striking direct relationships with demand-side ad platforms (DSPs), often creating their own private marketplaces so they can sell their own inventory on their own terms.

“They want to stay very innovative,” Xandr’s Soucaret adds. “So we see a lot of premium publishers finding innovative ways to give not only access to the VOD content, but also the linear inventory.”

For example, Xandr recently partnered with France’s Realytics so that customers of Xandr’s Invest buying platform can reach the 80% of the French linear TV market available through Realytics.

You are watching Where We Go From Here: The Lessons and Opportunities of 2020, a Beet.TV series presented by Xandr. For more videos, please visit this page.

]]>GDPR, CCPA, the deprecation of third-party cookies and new limits placed on certain mobile ad identifiers are sunsetting the age of audience hyper-targeting.

Now many people are pinning their hopes on contextual ad targeting – a practice through which ads would target against content, rather than people.

But, in this video interview with Beet.TV, Peter Mason, the co-founder of Illuma Technology, says contextual targeting is closer to audience targeting than many people realize.

Context overcomes cookies

“Contextual obviously overcomes the challenges that are coming into the industry,” Mason says.

“(But think of) context as (identifying) the momentary content consumption of an audience, as opposed to the historical content consumption of an audience, where you store that information on an identifier.

“Really, context is just the real-time part of that same user journey.”

Context with a twist

What tech companies today call “contextual targeting”, in some ways, has similarities with the traditional way ad targeting was done before digital – that is, adjacency to distinct kinds of content.

Of course, tech-enabled contextual targeting can go deeper than that, both using machine learning to divine granular descriptors of that content against which to buy and plugging into buying platforms to help advertisers do so automatically rather than manually.

Mason’s Illuma is one of the companies using AI to enable contextual ad targeting – but with a different spin, he says, called “moment targeting”.

“We use machine learning to learn in campaigns or using live signals from a campaign to isolate contexts that are driving the best engagement – effectively creating the right ‘contextual moment’ for that particular campaign,” Mason explains.

“And then we build a recommendation engine that basically allows you to perpetually change your contextual targeting in near real-time to capitalise on these fleeting user behaviours .”

Proof of the pudding

Those audiences are available as segments inside demand-side platforms (DSPs) like Xandr’s Invest.

“You buy an audience and that is your audience for that campaign,” Mason says. “And it will change very little during the campaign.

“We need DSPs that have that capability basically, to allow us to pass information dynamically into the segment so that traders can capitalise on these contextual behaviours.”

One advertiser, UK homeless charity Shelter, previously used Illuma through Xandr to get ads placed in pages which combined relevant content and audiences who were deemed to be most receptive, with the result of increasing donor levels.

You are watching Where We Go From Here: The Lessons and Opportunities of 2020, a Beet.TV series presented by Xandr. For more videos, please visit this page.

]]>Among those voters who are paying more attention are independents who are crucial in determining the election’s outcome in key swing states, according to the Political Edition of Xandr’s 2020 Relevance Report.

“Back in January, we discovered that independent voters were the least receptive and most difficult to engage with a political ad,” Charlotte Lipman, senior manager of business intelligence at Xandr, said in this interview with Beet.TV. “Now that we’re getting close to Election Day, and independent voters are getting closer to making their election decisions, we see their perceptions of political advertising have improved.”

While political campaigns are more likely to reach those voters now, they also need to be mindful that they don’t form a negative impression with advertising that’s too repetitive. Eighty-four percent of voters said they dislike seeing the same political ads over and over again, while 78% said they don’t like political ads that interrupt what they’re doing, Xandr’s survey found.

“The two best ways to improve advertising would be to reduce frequency of seeing the same message all the time, to improve on the intrusive ad experience,” Lipman said. “It’s no different for political advertising. They want ads to meet them at the right time and deliver new information in a relevant and trusted context.”

Source: Xandr, MarketCast

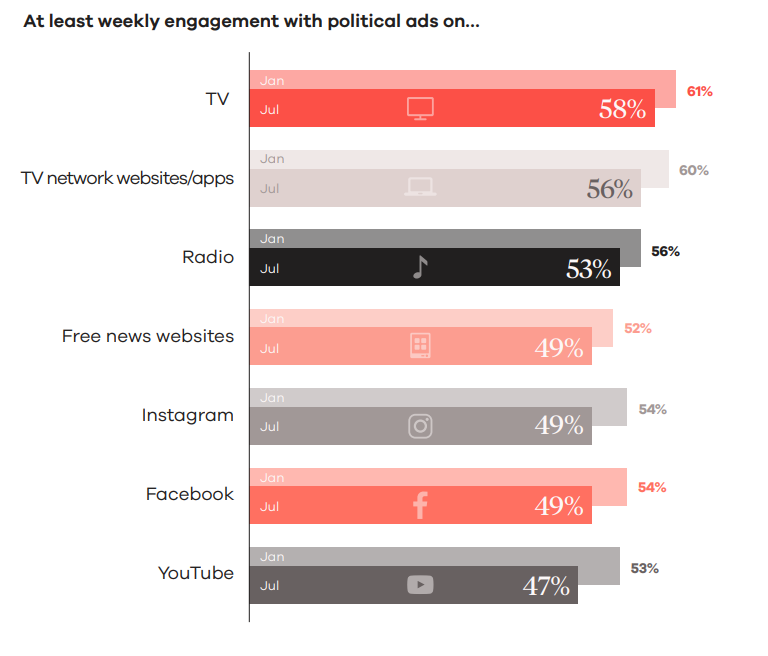

Likely voters were more likely to see a political ad on television than on other media outlets, making TV essential to political messaging. More than half (58%) of likely voters in July said they’d watched a political ad on TV, while 56% had seen those ads on a website or mobile app from a TV network, Xandr’s study found. Xandr commissioned researcher MarketCast to survey U.S. adults who were most likely to vote.

“Generally, we see positive sentiment toward the 2020 election,” Lipman said. “Voters are proud of the nation they live in, and hopeful for the future, but they’re also aware of the fact that politics has never been more polarizing. Unbiased advertising delivered in a trusted and positive environment has never been more crucial.”

In addition to reach and frequency, political advertisers also need to consider the context of the ad, especially as voters are being inundated with misinformation on social media and websites. Eighty-two percent of voters said it’s important that ads appear unbiased, Xandr’s study found.

“Lack of trust is a main driving force behind the ‘pain points’ that consumers feel toward engagement with political advertising,” Lipman said.

Ad targeting is another key concern, with 54% of voters saying they often see ads for candidates from other states and districts. Connected TV and over-the-top channels can reach constituents without dispersing the message too far.

“There’s been a lot of talk this election season from a CTV/OTT perspective for political advertisers, and we would expect this long after the election,” Lipman said.

You are watching Where We Go From Here: The Lessons and Opportunities of 2020, a Beet.TV series presented by Xandr. For more videos, please visit this page.

]]>