“The shift toward streaming is going to be probably bigger than it’s ever been this year,” Mark Rotblat, chief revenue officer at Tubi, the AVOD service owned by Fox Corp., said in this interview with Beet.TV. “Advertisers are recognizing they need to go where the eyeballs are.”

Advertisers will expand their spending on AVOD services in the U.S. from $4.4 billion last year to $17.8 billion by 2025, MoffettNathanson Research predicted.

As part of Fox, Tubi gives advertisers greater flexibility to reach audiences among the company’s broader portfolio of linear and digital video channels, which Rotblat describes as programming “pillars.”

“Certainly, there are those that want a place within different pillars,” he said. “Others are looking for ways to be a little bit more fluid in that they want a one-stop shop to then allocate across the different platforms, and be able to do so in a way that reaches their audience more fluidly.”

Rotblat said he expects to see more innovation in the software that marketers and their agencies use for their planning, buying and measurement among various media channels. They also can make quick changes to optimize their campaigns.

“It’s an exciting time for that, and there will be a lot more of that happening this year,” he said. “You know you need to buy streaming. You know you need to reach audiences everywhere, but how much? These planning tools do that.”

Audience-Based Targeting

As an ad-supported company, Tubi is focused on providing programming that drives viewership and engages audiences rather than what urges people to pay a subscription fee, Rotblat said. Tubi’s content recommendation engine makes the experience different for each viewer, based on their preferences.

“For us, it’s about having the largest library — which we have by a long shot — and then having the best personalization,” he said. “We’re using this content intelligence not just to serve our viewers from a personalization standpoint, but also … to develop new tools, new advertising-specific opportunities both in targeting and in insights that help on the context side.”

Rotblut sees Tubi as a hybrid between traditional TV that uses programming context “as a proxy for audience” and digital platforms that offer one-to-one targeting to specific consumers.

“There’s a very deep and rich middle ground where context could be gained in this space that has tens and hundreds of thousands of titles,” he said, “but the genres alone often don’t provide the richness of information that advertisers and agencies need to really understand the context. This is a space where we’re taking those tools for personalization, and our content intelligence, and giving rich insights back to the advertisers.”

You are watching “Optimizing a Rapidly Converging TV & Video Marketplace: What’s Next,” a Beet.TV leadership series presented by Amobee. For more videos, please visit this page.

]]>Shifting viewing behavior has been compounded by pandemic business economics.

In this video interview with Beet.TV, Mark Rotblat, CRO of Tubi, the ad-supported video platform acquired by Fox last year, says that leaves providers in the category sitting pretty.

Upfront bounce-back

“(Last year), some advertisers lessened their their upfront (TV ad spending) commitments, or they sat out completely – and then others jumped in and made up for it,” Rotblat says.

“The advertisers that tried to then change course and get back in middle of Q4, some of them were left out of what they really wanted in terms of amount of inventory.

“This year, we expect the pressure to be even greater as traditional brands that are in industries like automotive, entertainment and travel come back to full strength.”

What does full strength look like? It looks like traditional TV supplanted by new, ad-supported video-on-demand (AVOD) services. The likes of Tubi, Pluto TV and Xumo, amongst others, are offering viewers a TV-like experience and advertisers the targeting capabilities they have enjoyed in digital.

Murdoch’s expectations

Fox CEO: ‘We Can Win in the AVOD World’ – Media Play News: https://t.co/w43OwBqjgX #Tubi #Fox #AVOD pic.twitter.com/AjNrXCnDFC

— Media Play News (@MediaPlayNews) March 6, 2021

Which is why Fox came sniffing. In summer 2020, the company acquired Tubi for $440 million.

In last month’s earnings call, Fox Corporation CEO Lachlan Murdoch was bullish on the deal:

“We envision Tubi becoming a $1 billion business and a core pillar of Fox.

“Revenue for this past quarter alone broadly approximated Tubi’s revenue for the entire fiscal year before we acquired the company.

“We expect Tubi revenues to more than double in the current fiscal year, to exceed $300 million.”

If that target is also pressure, Rotblat doesn’t seem phased. “Tubi has been essentially P&L-neutral for Fox,” he says, “which is just so different than the businesses of SVoD competitors and those who are really losing billions a year on content as investment.”

Market position

It's an honor and a privilege. https://t.co/KQdUDU3HpV

— Tubi (@Tubi) February 17, 2021

Amid the ongoing boom in subscription video services (SVoD) like Netflix and Disney+, which are cornering the market for premium catalog, we are seeing the rise of free AVoD services, with acquisitions in tow – Xumo to Comcast, Pluto TV to Viacom and Tubi to Fox.

AVoD has become a key trend just as the services found new potential customers currently locked-down at home. More than 80% of Tubi’s viewing takes place on TV sets.

- Tubi is an ad-funded (AVoD) TV service at a time when many advertisers are pulling back on spending.

- But Tubi is also has also seen dramatic growth in stay-at-home viewing numbers during the pandemic.

- Targeting and control offered by digital-style buying may give advertisers the confidence they need in results from their spend.

- Consumers’ premium SVoD subscriptions may be tested in the months ahead – if economic conditions worsen, free TV could look attractive.

Complementarity

The Fox acquisition will help all of that. By November, Tubi was streaming about 200 million hours of content a month, up from about 160 million hours in its pre-pandemic days.

Rotblat says: “What’s different in the programme is we continue to get great Fox content from Fox Entertainment, and there’ll be more and more to announce as part of the upfronts this year,

“Tubi streamers are 20 years younger than the TV linear audiences. So that’s where there’s complementarity to those on linear and particular than on our Fox Entertainment and Fox portfolio of counterparts.

“We have about 80% of our streamers can’t be reached across the top 25 cable TV networks, 64% of Tubi streamers can’t be reached across Fox Entertainment.”

You are watching “The Stream 2021: New Audiences, New Opportunities,” a Beet.TV leadership series presented by Tubi. For more videos, please visit this page.

]]>“As an OTT company, we have been working to solve the unique difficulties of identity in that environment for the past five years,” said Mark Rotblat, chief revenue officer of Tubi, the ad-supported streaming service owned by Fox Corp., in this interview with Beet.TV. “It’s connected television, and OTT is cookieless.”

Tubi has seen significant growth this year as the coronavirus pandemic has led people to spend more time at home, binge-watching video content. Because Tubi carries advertising, it’s free to consumers who may be maxing their monthly media budgets on subscription video-on-demand (SVOD) services like Netflix, Disney+ and other bundles of programming. Tubi now streams about 200 million hours of content a month, up from about 160 million hours in its pre-pandemic days.

Source: Nielsen Streaming Meter data, July 2020

“With the pandemic, everything grew in terms of media consumption,” Rotblat said. “People were looking for more content, and they didn’t necessarily want to pay for more content. Tubi was an ideal place for viewers to go.”

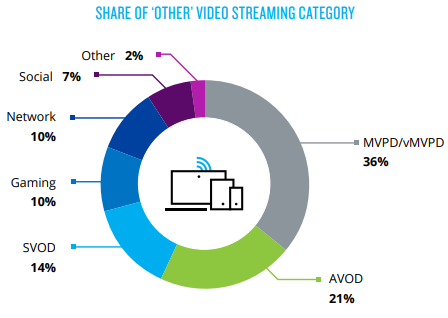

Tubi was among the ad-supported video on demand (AVOD) that major media companies started snapping this year as their viewership grew. Fox bought Tubi for $440 million, while Viacom acquired Pluto TV for $340 million and Comcast took over Xumo for an undisclosed sum. AVOD services make up about a fifth of the viewing time for streaming video services, researcher Nielsen said in a report published in August.

Gathering First-Party Data

A key part of Tubi’s strategy is to collect consumer data through its registration process, which asks for basic information that helps to track viewing habits every time a customer logs into its apps. It also relies on various technical identifiers for viewing devices.

“Really getting into first-party data and registration is very critical,” Rotblat said, adding that the company works to get more granular details about individuals within a household. “We started working with Transunion a little over a year ago to help enrich our own first-party data.”

By combining various sources of consumer data, Tubi can create a more complete profile of its audiences members.

“We have a very good view into how our viewers consume content, what types of content they watch at different points in the day, how different devices tie together within a home,” he said. “There is a lot of interest and focus on advanced measurement attribution, and I expect that to continue for quite some time.”

Collecting first-party data not only helps Tubi’s advertisers to target audiences, but it also helps the company to improve the user experience. Its platform has more than 23,000 titles, but doesn’t want to overwhelm people or make them search through hundreds of titles every time they log in.

“When you have that large of a library, the problem is: how do you get the right content in front of the viewers?” Rotblat said. “How do you have such a large library, but it doesn’t ‘feel’ that way? It feels like, ‘oh, this is exactly what I wanted to watch.'”

You are watching “The New Media Reality: A Consumer-Centric View of Identity and Personalization Emerges,” a Beet.TV Leadership Series presented by Transunion. For more videos, please visit this page.

]]>Today, Tubi announced it has done a deal with consumer credit profiling and data provider TransUnion which lets it add offline purchase and profiling data to the existing first-party data Tubi holds about its own audiences.

Such data is being seen as a valuable replacement to identifiers like third-party cookies, which are waning.

“It wasn’t just about taking data for digital individual targeting, but really understanding the households for content viewing, better discovery and of course the ad experience as well,” Tubi’s chief revenue officer Mark Rotblat says in this video with Beet.TV.

“One of our core tenets is to be the fastest path to entertainment,” he says. “We do a tremendous amount with our content viewing data to make that possible, but when you add signals about other people in the home – (like) whether there’s presence of children, information about language and other behaviors – these are things that can then be used as inputs to enhance that personalization engine, so that’s very important to us.

“We have registration data, we have content viewing data, we have information on the content and now we’ve got a great set of data about the household.”

In the announcement, TransUnion marketing solutions and media EVP Matt Spiegel says: “The integration of TransUnion data assets can help companies connect the dots to gain a more comprehensive understanding of today’s consumer and reach them with confidence – especially as they move and consume content in new ways.”

Pandemic popularity

Tubi’s leaning-in to personalization comes at a time when the coronavirus pandemic has swelled its viewership from stay-at-home consumers. Rotblat explains: “That growth has skyrocketed. The two weeks of after people started staying at home versus the prior two weeks, the growth in (viewership) was over 22%.

“In terms of new viewers, it was around 50% growth. What we’re seeing is not just more time-spent (watching) but also many, many more people joining for the first time.”

Stuck inside and feeling a little

?

We've rounded up 5 titles for the perfect distraction. #Binge them all now on Tubi, totally free.

The Simple Life (Seasons 1-4)

Little Man

Rugrats Go Wild

Imagine That

Good Burgerhttps://t.co/7rBegRlKou pic.twitter.com/ojPnuDxY5c

— Tubi | Stay In & Stream Freely (@Tubi) March 19, 2020

Amid the ongoing boom in subscription video services (SVoD) like Netflix and Disney+, which are cornering the market for premium catalog, we are seeing the rise of free AVoD services, with acquisitions in tow – Xumo to Comcast, Pluto TV to Viacom and Tubi to Fox.

AVoD has become a key trend just as the services found new potential customers currently locked-down at home. More than 80% of Tubi’s viewing takes place on TV sets.

Amid virus, Tubi sells

When Fox Corp agreed to buy Tubi TV in mid-March, it was on the cusp of the coronavirus pandemic.

With the $440 million transaction due to close on June 30, the deal is now noteworthy in three ways:

- Tubi is an ad-funded (AVoD) TV service at a time when many advertisers are pulling back on spending.

- But Tubi is also seeing dramatic growth in stay-at-home viewing numbers during the pandemic.

- Still, consumers’ premium SVoD subscriptions may be tested in the months ahead, if economic conditions worsen, leaving free TV looking attractive.

Tubi carries a library of over 20,000 titles. Amongst recently-disclosed December stats:

- 25 million monthly active users (up from 20 million in June).

- 163 million hours viewed in the month (160% year-on-year).

Whilst Tubi isn’t competing with the likes of Netflix for expensive original commissions, Rotblat doesn’t see a threat – he says most Tubi viewers are also Netflix subscribers because consumers want a range of programming.

]]>You heard it here first.

#yourewelcome https://t.co/gP7fnxxcSS

— Tubi | Stay In & Stream Freely (@Tubi) April 13, 2020

Last month at the Beet.TV executive retreat, we interviewed Tubi CRO Mark Rotblat about the company. We have republished the interview and story with today’s news:

It may be a fundamentally different business model, but there is one thing advertiser-supported video-on-demand (AVOD) services have in common with their subscription (SVOD) siblings – the importance of the content catalog.

Still, that fact does not give Mark Rotblat sleepless nights.

The chief revenue officer of Tubi, a growing AVOD service, says his company is confident about its catalog.

“We work with the largest studios, pretty much all the main studios and networks out there – Lionsgate, MGM, Paramount, et cetera. A&E, AMC – and so we work with over. I think. now 250 content providers,” he tells Beet.TV in this video interview.

“We are just getting more better content month over month. We’re (at) over 20,000 titles. And, while there’s a lot in the market about the Friends and the Seinfelds and those things being locked up for hundreds of millions of dollars, that’s not our focus or our concern because there still is something like over 700,000 titles out there in the market, and we want to provide access to that.

“The studios want services like Tubi to provide access to that and to make money from that.”

Something seems to be working. Rotblat shared December Tubi stats:

- 25 million monthly active users (up from 20 million in June).

- 163 million hours viewed in the month (160% year-on-year).

Here is the company’s press release on growth disclosed today.

A free app for a service that doesn’t require subscriptions, Tubi sells adds through both programmatic partner channels and direct to agencies and marketers.

Tubi pulled out of Europe, citing GDPR non-compliance, but plans to relaunch, including growing its 229-employee headcount overseas.

Rotblat was interviewed by TV[R]EV co-founder Alan Wolk at Beet Retreat San Juan 2020, where he was a participant.

This video was produced at the Beet Retreat San Juan 2020 sponsored by 605, DISH Media, NBCU, Roundel & Tubi. For more videos from the series, please visit this landing page.

]]>Advertiser-supported VOD (AVOD) is bringing ad support back on the agenda, even as the rise of pay-for video services brought many to conclude that the era of ad-funding was over.

Amongst the AVOD contenders are Peacock, Xumo, Pluto TV and Tubi.

In this video interview with Beet.TV, Tubi chief revenue officer Mark Rotblat says AVoD has an attractive complementary place alongside SVoD.

“There’s a lot of room,” he says. “Most of our viewers are Netflix subscribers, I think somewhere around 60%. They typically carry maybe another subscription that they bounce around.

“Maybe they are subscribing to HBO, and then Game of Thrones is over and they move on and then, ‘Oh, we’re going to Showtime’. And they binge something else. And we are the comfort blanket for everything else.”

Tubi carries a library of over 20,000 titles. Amongst recently-disclosed December stats:

- 25 million monthly active users (up from 20 million in June).

- 163 million hours viewed in the month (160% year-on-year).

Whilst the big SVoD services are currently spending big money on titles to entice subscribers, Rotblat says Tubi has a different agenda.

“We think we’re playing a different game,” he says. “We’re not throwing out money, 500 million for Friends. We are there finding the things that are going to keep people engaged.

“We think that’s the most important metric, is total viewing time. It’s about having them find something new, something they love every time they come to the service.”

So, what of Tubi’s ad model? Running just four to six minutes of ads per hour, Tubi may carry more ads than SVoD services, but it compares incredibly well, from a viewer perspective, against traditional TV.

Still, despite being happy with his current line-up, Rotblat thinks AVoD services will likely acquire SVoD’s shows at some point in the future.

“I think you’re going to see some things from some of these services that start to end up on services like Tubi,” he reckons. “There’s libraries that will be under-monetized by staying within the walls of the services that they were initially produced for.”

The panel was led by Beet.TV editorial and strategy director Jon Watts.

This video was produced at the Beet Retreat San Juan 2020 sponsored by 605, DISH Media, NBCU, Roundel & Tubi. For more videos from the series, please visit this landing page.

]]>Mark Rotblat, chief revenue officer of the free, ad-supported movie and TV streaming platform, told BeetTV during Advertising Week that the streaming wars help Tubi “greatly.” As more platforms launch, like Apple’s streaming network and NBC’s Peacock, more people will cut the cord, argues Rotblat.

“There’s been a decline in linear TV subscribers. The tipping point has happened,” says Rotblat, adding that most cord-cutters pay for between one and three subscriptions. Tubi, as it’s free, becomes a complementary add-on. Most Tubi subscribers subscribe to Netflix, according to Rotblat. “They use us when they say ‘I want more, but I don’t want to pay any more.’ Others like Peacock and Apple just adds to the incentives for people to cut the cord. Then they find us.”

That helps to shape Tubi’s pitch to advertisers, which are critical to the platform’s ad-supported model. According to Rotblat, Tubi has 20 million monthly uniques, over 15,000 titles and is now on more than 20 distribution platforms. During Advertising Week, the company announced it would be available on Vizio TV sets.

The age of cord-cutters

Tubi appeals to buyers who are seeking to maintain a relationship with cord-cutters. In the second quarter of 2019, Comcast, AT&T and Charter reported losing a combined 1.25 million subscribers, an increase of 1.1 million over the same quarter the year prior.

“It’s the same buyers buying television looking to get reach to target audiences, which are declining as linear TV subscriptions just fall off the cliff,” says Rotblat. “Things are changing very rapidly – where are they going to reach that audient? They can reach them on OTT.”

Rotblat says Tubi’s strength is that “it looks like TV,” thanks to its movie and television library and advertisements, without being tethered to a cable package. As cord-cutting continues, that’s an advantage.

This video is part of a series of interviews conducted during Advertising Week New York, 2019. This series is co-production of Beet.TV and Advertising Week. The series is sponsored by Roundel, a Target company. Please see more videos from Advertising Week right here.

]]>“The marketplace for ad-supported is a coiled spring,” Tubi Chief Revenue Officer Mark Rotblat says in this interview with Beet.TV.

In discussing increased demand from advertisers, Rotblat recalls that during last year’s TV UpFront season, some buyers wished to finish their negotiations with linear TV provider before committing money to ad-supported OTT platforms.

“It’s different this year. This year they are planning OTT alongside their traditional TV, their cable and broadcast. And the reason is that they got burned” by “over-promising and under-delivering” linear audiences.

“It’s just too difficult to move the money into ADU’s from one quarter to the next,” Rotblat says, referring to audience-deficiency units. “They need to run flighting and get reach to their target audiences. So this is the place and now’s the time.”

Tubi’s collaboration with Samba TV and its automatic content recognition alliances with smart-TV companies will help to “bridge the measurement gap” of reach and frequency from traditional TV to OTT.

“The results that we’ve seen in the campaigns we’ve done are very promising. Because there’s not just low overlap to television buys but even low overlap to other OTT,” Rotblat says. For example, he cites data from consumer research firm MRI as showing just a 22% overlap between Hulu and Tubi.

“Working with our platform is pretty easy because Samba has built the technology. So it’s really just a pixel implementation.”

Rotblat cites a “super panel” from some 3.5 million, Samba-enabled smart-TV’s that see everything people are watching. “They can understand duplication of that ad or frequency to a specific target.” IP-enabled television and devices within a home can reveal “other behaviors in the home” and correlate them to advertising exposures.

Even as consumers have begun to mix and match subscription-TV services to their liking, some advertisers have held off from committing to the OTT space, according to Rotblat. He mentions research suggesting that Americans will ultimately choose two TV apps. “It leaves this wide open field for free, ad supported for everything else they get.”

At Tubi’s Digital Content NewFront presentation, the company announced longer-form advertising opportunities, including 60- and 90-second formats, trailers and sponsorships. This is in addition to the new opportunity for advertisers to “target and get guaranteed impressions for the first position in the pod.”

Tubi also unveiled an exclusive deal with global content leader Lionsgate to bring all 100 episodes of Debmar-Mercury and sister company Lionsgate Television’s comedy Anger Management to its customers.

This video is part of a series about the emergence of OTT as an advertising platform. For more interviews, please visit this page. This series is presented by Premion.

]]>“Before us there was YouTube and Netflix and that was it,” says Chief Revenue Officer Mark Rotblat. “We are across all the major platforms, eighteen of them, mostly on televisions.”

Those platforms include Roku, Amazon Fire, Samsung and Sony smart TV’s, along with gaming consoles, mobile devices and Android TV. In November of 2018, Tubi expanded its footprint by adding 20 million homes in the Comcast Xfinity X1 footprint.

A free app for a service that doesn’t require subscriptions, Tubi sells adds through both programmatic partner channels and direct to agencies and marketers, Rotblat explains in this interview with Beet.TV at CES 2019. “Really, whichever model works best for the buyer. What they love is that it’s only movies and TV shows.”

Since there’s no digital short-form content among the more than 9,000 movie and TV titles available on Tubi, “It really looks like what they buy in television and it solves the problem of linear ratings in decline, making it harder for them to reach their target audience through linear. It’s the cord cutters and cord nevers that are spending more and more time in OTT,” says Rotblat.

Asked about the growing number of direct-to-consumer video services slated for launch by major media companies, Rotblat says, “You’ll see in all these announcements are subscription services. Whether it’s skinny bundles or otherwise, there’s competition for that type of content. But we’re really feeling that there’s going to be some subscription fatigue.”

He describes Tubi viewers as “media enthusiasts who typically have one or two subscriptions “and they kind of bounce around. They might have Showtime for a month, Hulu for a month for this show. But we’re kind of the consistent that they know they can go and find just a massive library and it’s free. They’re willing to have ads if it’s a light ad load that’s unobtrusive.”

Tubi’s ad load around four to six minutes an hour, about a third of what’s on linear TV, according to Rotblat. Ad inventory is mainly 15- and 30-second ads managed through the company’s own ad server, “and we have on average three to five ads per pod every fifteen minutes or so.”

Tubi is similar to Pluto TV, which was recently acquired by Viacom for $340 million. Pluto TV is expected to complement Viacom’s cable distribution, as USA TODAY reports.

This video is part of Beet.TV coverage of CES 2019. The series is sponsored by NBCUniversal. For more coverage, please visit this page.

]]>